HP 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

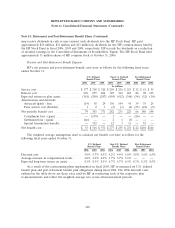

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

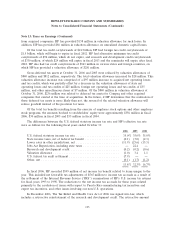

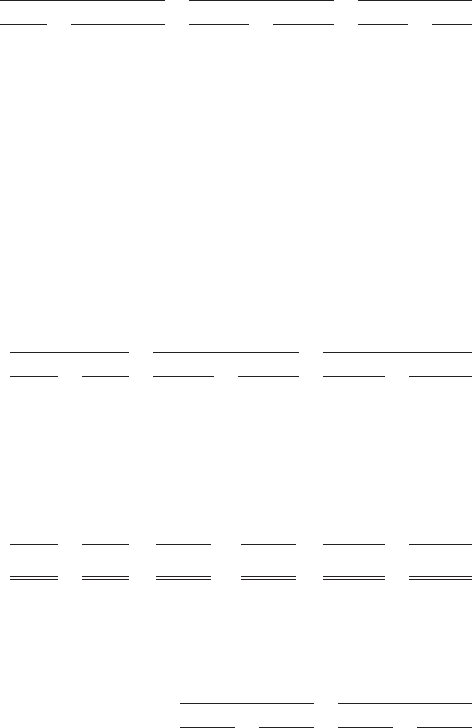

The weighted average assumptions used to calculate the benefit obligation as of the September 30

measurement date were as follows:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2006 2005 2006 2005 2006 2005

Discount rate ......................... 5.8% 5.6% 4.4% 4.2% 5.8% 5.7%

Average increase in compensation levels ..... 4.0% 4.0% 3.3% 3.7% — —

Current medical cost trend rate ........... — — — — 8.5% 9.5%

Ultimate medical cost trend rate ........... — — — — 5.5% 5.5%

Year the rate reaches ultimate trend rate ..... — — — — 2010 2010

A 1.0 percentage point increase in the medical cost trend rate would have increased the total

post-retirement benefit obligation reported at October 31, 2006 by $30 million, while a 1.0 percentage

point decrease would have resulted in a decrease of $36 million.

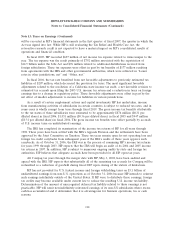

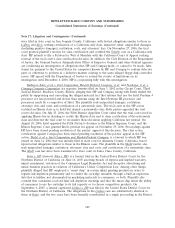

The net amount recognized for HP’s defined benefit and post-retirement benefit plans was as

follows for the following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2006 2005 2006 2005 2006 2005

In millions

Prepaid benefit costs .................... $ — $395 $1,527 $1,494 $ — $ —

Pension, post-retirement and post-employment

liabilities ........................... (502) (915) (297) (284) (1,053) (1,110)

Intangible asset ........................ — — 4 — — —

Accumulated other comprehensive loss ....... — — 30 20 — —

Contribution after measurement date ........ — — 25 19 4 4

Net amount recognized .................. $(502) $(520) $1,289 $1,249 $(1,049) $(1,106)

Defined benefit plans with projected benefit obligations exceeding the fair value of plan assets

were as follows:

U.S. Defined Non-U.S. Defined

Benefit Plans Benefit Plans

2006 2005 2006 2005

In millions

Aggregate fair value of plan assets ........................ $4,325 $1,929 $1,984 $5,211

Aggregate projected benefit obligation ..................... $4,688 $2,677 $2,411 $5,824

123