HP 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

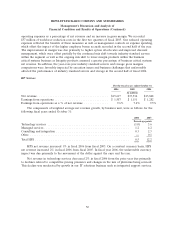

Amortization of Purchased Intangible Assets

The decrease in amortization expense in fiscal 2006 as compared to fiscal 2005 was due primarily

to a decrease in amortization expense related to certain intangible assets associated with prior

acquisitions including Compaq Computer Corporation (‘‘Compaq’’) acquisition that had reached the

end of their amortization period, partially offset by an increase in amortization expense related

primarily to the Scitex Vision Ltd. (‘‘Scitex’’), Peregrine Systems, Inc. (‘‘Peregrine’’), and OuterBay

Technologies, Inc. (‘‘OuterBay’’) acquisitions in fiscal year 2006.

The increase in amortization expense in fiscal 2005 as compared to fiscal 2004 was due primarily

to the amortization of intangible assets related to the acquisitions of Triaton in April 2004, Synstar PLC

(‘‘Synstar’’) in October 2004 and SAC, LLC (‘‘Snapfish’’) in April 2005, as well as accelerated

amortization related to the early termination of certain acquired customer contracts.

For more information on our amortization of purchased intangibles assets, see Note 7 to the

Consolidated Financial Statements in Item 8, which is incorporated herein by reference.

Acquisition-Related Charges

Acquisition-related charges in fiscal 2004 consisted of costs related to Compaq acquisition, which

included primarily the amortization of deferred compensation, merger-related inventory adjustments

and professional fees.

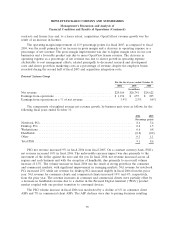

In-Process Research and Development Charges

We record in-process research & development (‘‘IPR&D’’) charges in connection with acquisitions

accounted for as business combinations, as more fully described in Note 6 to the Consolidated

Financial Statements in Item 8. In fiscal 2006, 2005 and 2004 we recorded IPR&D charges of

$52 million, $2 million and $37 million, respectively, related to acquisitions during those years.

Interest and Other, Net

Interest and other, net increased by $417 million in fiscal 2006 from fiscal 2005. The increase in

fiscal 2006 resulted primarily from higher net interest income over the prior year related to higher

short-term interest rates in fiscal 2006, net gains from sales of certain real estate properties, and lower

interest expenses due to our lower average debt balances. The increase in fiscal 2006 also was

attributable to a charge recorded in fiscal 2005 for estimated sales and use taxes and related interest

associated with pre-acquisition Compaq sales and use tax audits as described below.

Interest and other, net increased by $154 million in fiscal 2005 from fiscal 2004. The increase in

fiscal 2005 was the result primarily of higher short-term U.S. interest rates, which increased the interest

income from our cash balances and reduced the cost associated with foreign exchange hedges.

Increased interest expense and a charge related to a sales and use tax audit of Compaq prior to its

acquisition by HP for the fiscal years 1998-2002 partially offset the increase in interest and other, net

for fiscal 2005.

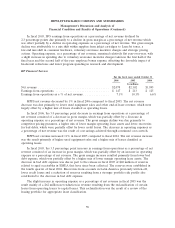

Gains (Losses) on Investments

Net gains in fiscal 2006 resulted primarily from gains on the sale of investments, which were offset

in part by impairment charges on our investment portfolio. Net losses in fiscal 2005 resulted primarily

from impairment charges on equity investments in our publicly-traded and privately-held investment

48