HP 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

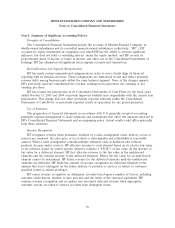

Taxes on Earnings

HP recognizes deferred tax assets and liabilities for the expected tax consequences of temporary

differences between the tax bases of assets and liabilities and their reported amounts using enacted tax

rates in effect for the year the differences are expected to reverse. HP records a valuation allowance to

reduce the deferred tax assets to the amount that is more likely than not to be realized.

Cash and Cash Equivalents

HP classifies investments as cash equivalents if the maturity of an investment is three months or

less from the purchase date. Interest income was approximately $623 million in fiscal 2006, $424 million

in fiscal 2005 and $238 million in fiscal 2004.

Allowance for Doubtful Accounts

HP establishes an allowance for doubtful accounts to ensure trade and financing receivables are

not overstated due to uncollectibility. HP maintains bad debt reserves based on a variety of factors,

including the length of time receivables are past due, trends in overall weighted average risk rating of

the total portfolio, macroeconomic conditions, significant one-time events, historical experience and the

use of third-party credit risk models that generate quantitative measures of default probabilities based

on market factors and the financial condition of customers. HP records a specific reserve for individual

accounts when HP becomes aware of a customer’s inability to meet its financial obligations, such as in

the case of bankruptcy filings or deterioration in the customer’s operating results or financial position.

If circumstances related to customers change, HP would further adjust estimates of the recoverability of

receivables.

Inventory

HP values inventory at the lower of cost or market, with cost computed on a first-in, first-out basis.

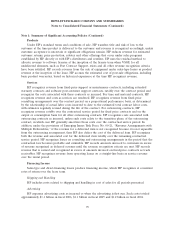

Property, Plant and Equipment

HP states property, plant and equipment at cost less accumulated depreciation. HP capitalizes

additions, improvements and major renewals. HP expenses maintenance, repairs and minor renewals as

incurred. HP provides depreciation using straight-line or accelerated methods over the estimated useful

lives of the assets. Estimated useful lives are 5 to 40 years for buildings and improvements and 3 to

15 years for machinery and equipment. HP depreciates leasehold improvements over the life of the

lease or the asset, whichever is shorter. HP depreciates equipment held for lease over the initial term

of the lease to the equipment’s estimated residual value.

Goodwill and Indefinite-Lived Purchased Intangible Assets

Statement of Financial Accounting Standards (‘‘SFAS’’) No. 142, ‘‘Goodwill and Other Intangible

Assets’’ (‘‘SFAS 142’’), prohibits the amortization of goodwill and purchased intangible assets with

indefinite useful lives. HP reviews goodwill and purchased intangible assets with indefinite lives for

impairment annually at the beginning of its fourth fiscal quarter and whenever events or changes in

circumstances indicate the carrying value of an asset may not be recoverable in accordance with

SFAS 142. For goodwill, HP performs a two-step impairment test. In the first step, HP compares the

fair value of each reporting unit to its carrying value. HP determines the fair value of its reporting

units based on a weighting of income and market approaches. Under the income approach, HP

calculates the fair value of a reporting unit based on the present value of estimated future cash flows.

80