HP 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

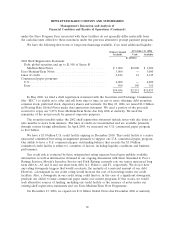

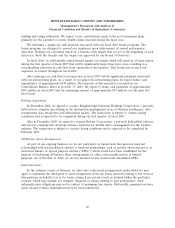

Contractual Obligations

The impact that our contractual obligations as of October 31, 2006 are expected to have on our

liquidity and cash flow in future periods was as follows:

Payments Due by Period

Less than More than

Total 1 Year 1-3 Years 3-5 Years 5 Years

In millions

Long-term debt, including capital lease obligations(1) $4,787 $2,099 $1,597 $ 19 $1,072

Operating lease obligations ................... 2,065 506 718 395 446

Purchase obligations(2) ...................... 2,777 2,052 504 198 23

Total ................................... $9,629 $4,657 $2,819 $612 $1,541

(1) Amounts represent the expected cash payments of our long-term debt and do not include any fair

value adjustments or discounts. Included in our long-term debt are approximately $52 million of

capital lease obligations that are secured by certain equipment.

(2) Purchase obligations include agreements to purchase goods or services that are enforceable and

legally binding on us and that specify all significant terms, including fixed or minimum quantities

to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. Purchase obligations exclude agreements that are cancelable without penalty. These

purchase obligations are related principally to cost of sales, inventory and other items. Our

purchase obligation includes the settlement agreement with EMC Corporation (‘‘EMC’’) pursuant

to which we agreed to pay $325 million (the net amount of the valuation of EMC’s claims against

us less the valuation of our claims against EMC) to EMC, which we can satisfy through the

purchase for resale or internal use of complementary EMC products in equal installments of

$65 million over the next five years, of which the first installment was paid on August 29, 2005. As

of October 31, 2006, the remaining payment to EMC was $260 million. In addition, if EMC

purchases our products during the five-year period, we will be required to purchase an equivalent

amount of additional products or services from EMC of up to an aggregate of $108 million.

In November 2006, we completed our acquisition of Mercury. The aggregate purchase price was

approximately $4.8 billion, consisting of cash paid for outstanding stock, the value of vested employee

stock options and estimated direct transaction costs. The acquisition will combine Mercury’s application

management, application delivery and IT governance capabilities with our broad portfolio of

management solutions.

Funding Commitments

During fiscal 2006, we made approximately $270 million and $31 million of contributions to our

pension plans and U.S. non-qualified plan participants, respectively, and paid $67 million to cover

benefit claims for post-retirement benefit plans. In fiscal 2007, we expect to contribute approximately

$120 million to our pension plans and approximately $15 million to cover benefit payments to U.S.

non-qualified plan participants. We expect to pay approximately $80 million to cover benefit claims for

our post-retirement benefit plans. Our funding policy is to contribute cash to our pension plans so that

we meet at least the minimum contribution requirements, as established by local government and

66