HP 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

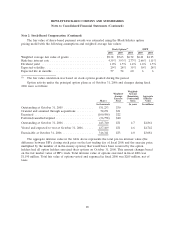

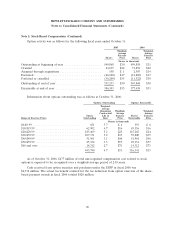

Note 2: Stock-Based Compensation (Continued)

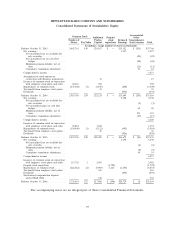

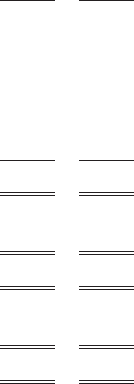

The pro forma table below reflects net earnings and basic and diluted net earnings per share for

the following fiscal years ended October 31, if HP had applied the fair value recognition provisions of

SFAS 123:

2005 2004

In millions, except

per share amounts

Net earnings, as reported ............................................ $2,398 $3,497

Add: stock-based compensation included in reported net earnings, net of related tax

effects ........................................................ 144 33

Less: stock-based compensation expense determined under the fair-value based

method for all awards, net of related tax effects .......................... (621) (692)

Pro forma net earnings .............................................. $1,921 $2,838

Basic net earnings per share:

As reported .................................................... $ 0.83 $ 1.16

Pro forma ...................................................... $ 0.67 $ 0.94

Diluted net earnings per share:

As reported .................................................... $ 0.82 $ 1.15

Pro forma ...................................................... $ 0.66 $ 0.93

Employee Stock Purchase Plan

HP sponsors the Hewlett-Packard Company 2000 Employee Stock Purchase Plan, also known as

the Share Ownership Plan (the ‘‘ESPP’’), pursuant to which eligible employees may contribute up to

10% of base compensation, subject to certain income limits, to purchase shares of HP’s common stock.

Prior to November 1, 2005, employees were able to purchase stock semi-annually at a price equal to

85% of the fair market value at certain plan-defined dates. As of November 1, 2005, HP changed the

ESPP so that employees will purchase stock semi-annually at a price equal to 85% of the fair market

value on the purchase date. Since the price of the shares is now determined at the purchase date and

there is no longer a look-back period, HP recognizes the expense based on the 15% discount at

purchase. In fiscal 2006, ESPP compensation expense was $53 million, net of taxes. At October 31,

2006, approximately 147,000 employees were eligible to participate and approximately 53,000 employees

were participants in the ESPP. In fiscal 2006, participants purchased 11,076,000 shares of HP common

stock at a weighted-average price of $30 per share. In fiscal 2005, participants purchased 20,673,000

shares of HP common stock at a weighted-average price of $17 per share. In fiscal 2004, participants

purchased 25,868,000 shares of HP common stock at a weighted-average price of $14 per share.

Incentive Compensation Plans

HP stock option plans include principal plans adopted in 2004, 2000, 1995 and 1990 (‘‘principal

option plans’’), as well as various stock option plans assumed through acquisitions under which stock

options are outstanding. All regular employees meeting limited employment qualifications were eligible

to receive stock options in fiscal 2006. There were approximately 110,000 employees holding options

under one or more of the option plans as of October 31, 2006. Options granted under the principal

option plans are generally non-qualified stock options, but the principal option plans permit some

options granted to qualify as ‘‘incentive stock options’’ under the U.S. Internal Revenue Code. The

87