HP 2006 Annual Report Download - page 68

Download and view the complete annual report

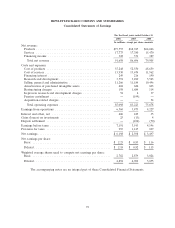

Please find page 68 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

We repurchase shares of our common stock under an ongoing program to manage the dilution

created by shares issued under employee stock plans as well as to repurchase shares opportunistically.

This program authorizes repurchases in the open market or in private transactions. We completed share

repurchases of approximately 150 million shares, of which 148 million shares were settled for

$3.5 billion in fiscal 2005, as compared to repurchases and settlements of approximately 172 million

shares for $3.3 billion in fiscal 2004. In addition, in November 2004, we paid $51 million in connection

with the completion of the fiscal 2004 accelerated share repurchase program. We intend to continue to

repurchase shares as a means to manage dilution from the issuance of shares under employee benefit

plans and to repurchase shares opportunistically. During fiscal 2005, the Board of Directors of HP

authorized an additional $4.0 billion for future repurchases of our outstanding shares of common stock.

As of October 31, 2005, we had remaining authorization of approximately $3.4 billion for future share

repurchases.

LIQUIDITY

As previously discussed, we use cash generated by operations as our primary source of liquidity,

since we believe that internally generated cash flows are sufficient to support business operations,

capital expenditures and the payment of stockholder dividends, in addition to a level of discretionary

investments and share repurchases. We are able to supplement this near term liquidity, if necessary,

with broad access to capital markets and credit line facilities made available by various foreign and

domestic financial institutions.

We maintain debt levels that we establish through consideration of a number of factors, including

cash flow expectations, cash requirements for operations, investment plans (including acquisitions),

share repurchase activities and the overall cost of capital. Outstanding debt remained at $5.2 billion as

of October 31, 2006 as compared to October 31, 2005, bearing weighted average interest rates of 5.1%

and 4.7%, respectively. Short-term borrowings increased to $2.7 billion at October 31, 2006 from

$1.8 billion at October 31, 2005. The increase was due primarily to the reclassification from long-term

to short-term of $2.0 billion of U.S. Dollar Global Notes, of which $1.0 billion matured in

December 2006 and $1.0 billion will mature in July 2007. This increase was offset partially by the

repayment of $200 million Series A Medium-Term Notes in December 2005 and 750 million Euro

Medium-Term Notes in July 2006, as well as a decrease of $18 million in commercial paper. During

fiscal 2006, we both issued and repaid approximately $5.4 billion of commercial paper. As of

October 31, 2006, we had $16.4 million in total borrowings collateralized by certain financing receivable

assets.

HP, and not the HPFS financing business, issued the vast majority of our total outstanding debt.

Like other financial services companies, HPFS has a business model that is asset-intensive in nature

and therefore is more debt-dependent than our other business segments. At October 31, 2006, HPFS

had approximately $7.2 billion in net portfolio assets, which included short-and long-term financing

receivables and operating lease assets.

We have revolving trade receivables-based facilities permitting us to sell certain trade receivables

to third parties on a non-recourse basis. The aggregate maximum capacity under these programs was

approximately $477 million as of October 31, 2006 and there was approximately $150 million available

under these programs. In fiscal 2006, we had another facility that was subject to a maximum amount of

525 million euros (the ‘‘Euro Program’’), which was terminated on October 31, 2006. We sold

approximately $8.6 billion of trade receivables during fiscal 2006, including approximately $5.9 billion

64