HP 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

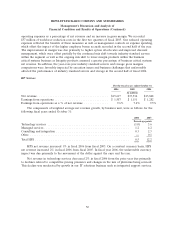

PC sales were the leading contributor to net revenue growth in PSG. HPS achieved net revenue growth

across all businesses in fiscal 2005 due in large part to the impact of acquisitions (benefiting primarily

technology services) and favorable currency impacts. Additionally, managed services net revenue

increased due to both new contract signings and additional contract revenue from the installed base. In

fiscal 2005, ESS net revenue growth was the result primarily of continued strong sales of industry

standard servers, particularly our ProLiant server line, due to volume increases and higher ASPs

resulting from improved option attach rates. IPG net revenue growth in fiscal 2005 was the result of

increased unit growth of printer supplies, particularly LaserJet toner, as a result of the increasing

demand for color-related products. The demand for color-related products also added to the revenue

growth in commercial hardware. Both Software and HPFS contributed to HP net revenue growth for

fiscal 2005 as growing acceptance of our OpenView product offerings contributed to Software revenue

growth while higher used equipment sales and a higher mix of operating leases benefited HPFS.

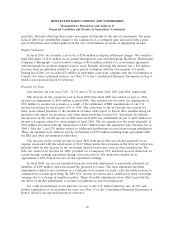

Stock-Based Compensation Expense

Effective November 1, 2005, we adopted the fair value recognition provisions of SFAS 123R using

the modified prospective transition method and therefore have not restated results for prior periods.

Our results of operations in fiscal 2006 were impacted by the recognition of non-cash expense related

to the fair value of our share-based payment awards. In fiscal 2006, we recorded $536 million in pre-tax

stock-based compensation expense based on SFAS 123R, of which $144 million was included in cost of

sales, $70 million was included in research and development expense and $322 million was included in

sales, general and administrative expense. Total stock-based compensation expense for SFAS 123R, net

of taxes, in fiscal 2006 was $376 million. In addition, we recognized an adjustment of $14 million to

reduce non-cash stock-based compensation expense which was included as part of our restructuring

expenses. The stock-based compensation expense related to HP-granted employee stock options and

the employee stock purchase plan is recorded at the corporate level and therefore does not have an

impact on segment results. See Note 2 to the Consolidated Financial Statements in Item 8, which is

incorporated herein by reference.

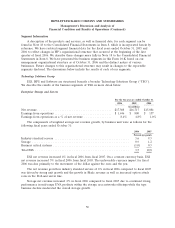

Gross Margin

The weighted average components of the change in gross margin were as follows for the following

fiscal years ended October 31:

2006 2005

Percentage points

Enterprise Storage and Servers ......................................... 0.4 0.1

HP Services ....................................................... 0.2 (0.5)

Imaging and Printing Group ........................................... 0.2 (0.8)

Software ......................................................... 0.2 0.1

Personal Systems Group .............................................. 0.1 0.5

HP Financial Services ................................................ (0.1) 0.1

Corporate Investments/Other .......................................... (0.1) —

Total HP ......................................................... 0.9 (0.5)

44