HP 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the minimum and maximum price as well as regulatory limitations on the number of shares HP is

permitted to repurchase. HP decreases its shares outstanding each settlement period as shares are

physically received. HP will retire all shares repurchased under the PVSPP, and HP will no longer deem

those shares outstanding. See Note 14 to the Consolidated Financial Statements in Item 8 for more

details.

On August 15, 2006, HP’s Board of Directors authorized an additional $6.0 billion for future

repurchases of outstanding shares of common stock. As of October 31, 2006, HP had remaining

authorization of approximately $5.6 billion for future share repurchases. Previously authorized share

repurchases also will be made under the PVSPP until the remaining available balance is exhausted in

the second quarter of fiscal 2007.

ITEM 6. Selected Financial Data.

The information set forth below is not necessarily indicative of results of future operations, and

should be read in conjunction with Item 7, ‘‘Management’s Discussion and Analysis of Financial

Condition and Results of Operations,’’ and the Consolidated Financial Statements and notes thereto

included in Item 8, ‘‘Financial Statements and Supplementary Data,’’ of this Form 10-K, which are

incorporated herein by reference, in order to understand further the factors that may affect the

comparability of the financial data presented below.

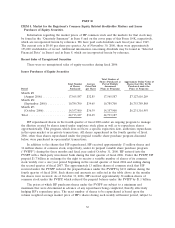

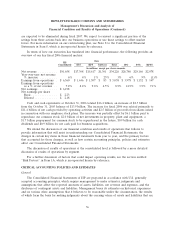

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Selected Financial Data(1)

For the fiscal years ended October 31,

2006 2005 2004 2003 2002

In millions, except per share amounts

Net revenue .............................. $91,658 $86,696 $79,905 $73,061 $56,588

Earnings (loss) from operations(2) .............. $ 6,560 $ 3,473 $ 4,227 $ 2,896 $ (1,012)

Net earnings (loss)(2)(3) ...................... $ 6,198 $ 2,398 $ 3,497 $ 2,539 $ (903)

Net earnings (loss) per share(2)(3)

Basic ................................. $ 2.23 $ 0.83 $ 1.16 $ 0.83 $ (0.36)

Diluted ................................ $ 2.18 $ 0.82 $ 1.15 $ 0.83 $ (0.36)

Cash dividends declared per share .............. $ 0.32 $ 0.32 $ 0.32 $ 0.32 $ 0.32

At year-end:

Total assets ............................. $81,981 $77,317 $76,138 $74,716 $70,710

Long-term debt .......................... $ 2,490 $ 3,392 $ 4,623 $ 6,494 $ 6,035

(1) HP’s Consolidated Financial Statements and notes thereto reflect HP’s acquisition of Compaq on

May 3, 2002. The occurrence of the acquisition in the middle of fiscal 2002 affects the

comparability of financial information for fiscal years after 2002.

33