HP 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

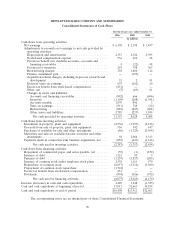

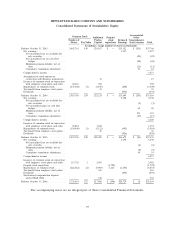

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the fiscal years ended October 31

2006 2005 2004

In millions

Cash flows from operating activities:

Net earnings ....................................... $ 6,198 $ 2,398 $ 3,497

Adjustments to reconcile net earnings to net cash provided by

operating activities:

Depreciation and amortization ........................ 2,353 2,344 2,395

Stock-based compensation expense ..................... 536 104 48

Provision (benefit) for doubtful accounts—accounts and

financing receivables .............................. 4 (22) 98

Provision for inventory .............................. 267 398 367

Restructuring charges .............................. 158 1,684 114

Pension curtailment gain ............................ — (199) —

Acquisition-related charges, including in-process research and

development ................................... 52 2 91

Deferred taxes on earnings ........................... 693 (162) 26

Excess tax benefit from stock-based compensation .......... (251) — —

Other, net ....................................... (7) (69) 61

Changes in assets and liabilities:

Accounts and financing receivables ................... (882) 666 (696)

Inventory ...................................... (1,109) (208) (1,341)

Accounts payable ................................ 1,879 846 3

Taxes on earnings ................................ (513) 748 (32)

Restructuring ................................... (810) (247) (601)

Other assets and liabilities ......................... 2,785 (255) 1,058

Net cash provided by operating activities ............. 11,353 8,028 5,088

Cash flows from investing activities:

Investment in property, plant and equipment ............... (2,536) (1,995) (2,126)

Proceeds from sale of property, plant and equipment ......... 556 542 447

Purchases of available-for-sale and other investments ......... (46) (1,729) (3,964)

Maturities and sales of available-for-sale securities and other

investments ...................................... 94 2,066 4,313

Payments made in connection with business acquisitions, net .... (855) (641) (1,124)

Net cash used in investing activities ................. (2,787) (1,757) (2,454)

Cash flows from financing activities:

Repayment of commercial paper and notes payable, net ....... (55) (1) (172)

Issuance of debt .................................... 1,121 84 9

Payment of debt .................................... (1,259) (1,827) (285)

Issuance of common stock under employee stock plans ........ 2,538 1,161 570

Repurchase of common stock .......................... (6,057) (3,514) (3,309)

Prepayment of common stock repurchase .................. (1,722) — —

Excess tax benefit from stock-based compensation ........... 251 — —

Dividends ......................................... (894) (926) (972)

Net cash used in financing activities ................. (6,077) (5,023) (4,159)

Increase (decrease) in cash and cash equivalents .............. 2,489 1,248 (1,525)

Cash and cash equivalents at beginning of period .............. 13,911 12,663 14,188

Cash and cash equivalents at end of period .................. $16,400 $13,911 $12,663

The accompanying notes are an integral part of these Consolidated Financial Statements.

76