HP 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

Information regarding the market prices of HP common stock and the markets for that stock may

be found in the ‘‘Quarterly Summary’’ in Item 8 and on the cover page of this Form 10-K, respectively,

which are incorporated herein by reference. We have paid cash dividends each fiscal year since 1965.

The current rate is $0.08 per share per quarter. As of November 30, 2006, there were approximately

153,000 stockholders of record. Additional information concerning dividends may be found in ‘‘Selected

Financial Data’’ in Item 6 and in Item 8, which are incorporated herein by reference.

Recent Sales of Unregistered Securities

There were no unregistered sales of equity securities during fiscal 2006.

Issuer Purchases of Equity Securities

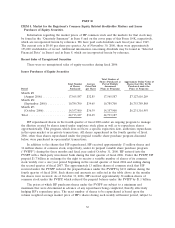

Total Number of

Shares Purchased as Approximate Dollar Value of

Total Number Average Part of Publicly Shares that May Yet Be

of Shares Price Paid Announced Purchased under the

Period Purchased per Share Plans or Programs Plans or Programs

Month #1

(August 2006) ............. 17,565,587 $32.85 17,565,587 $7,127,610,269

Month #2

(September 2006) .......... 10,789,700 $34.65 10,789,700 $6,753,789,848

Month #3

(October 2006) ............ 14,357,900 $36.39 14,357,900 $6,231,316,993

Total ..................... 42,713,187 $34.49 42,713,187

HP repurchased shares in the fourth quarter of fiscal 2006 under an ongoing program to manage

the dilution created by shares issued under employee stock plans as well as to repurchase shares

opportunistically. This program, which does not have a specific expiration date, authorizes repurchases

in the open market or in private transactions. All shares repurchased in the fourth quarter of fiscal

2006, other than shares repurchased under the prepaid variable share purchase program discussed

below, were purchased in open market transactions.

In addition to the shares that HP repurchased, HP received approximately 13 million shares and

34 million shares of common stock, respectively, under its prepaid variable share purchase program

(‘‘PVSPP’’) during the three months and fiscal year ended October 31, 2006. HP entered into the

PVSPP with a third-party investment bank during the first quarter of fiscal 2006. Under the PVSPP, HP

prepaid $1.7 billion in exchange for the right to receive a variable number of shares of its common

stock weekly over a one year period beginning in the second quarter of fiscal 2006 and ending during

the second quarter of fiscal 2007. The approximately 13 million shares of common stock that HP

received under the PVSPP reduced the prepaid balance under the PVSPP by $431 million during the

fourth quarter of fiscal 2006. Such shares and amounts are reflected in the table above in the months

the shares were received. As of October 31, 2006, HP received approximately 34 million shares of

common stock under the PVSPP, which reduced the prepaid balance under the PVSPP by $1.1 billion.

The prices at which HP purchases shares under the PVSPP are subject to a minimum and

maximum that were determined in advance of any repurchases being completed, thereby effectively

hedging HP’s repurchase price. The exact number of shares to be repurchased is based upon the

volume weighted average market price of HP’s shares during each weekly settlement period, subject to

32