HP 2006 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

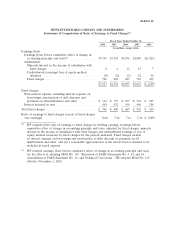

Exhibit 12

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Statements of Computation of Ratio of Earnings to Fixed Charges(1)

Fiscal Years Ended October 31,

2006 2005 2004 2003 2002

In millions, except ratios

Earnings (loss):

Earnings (loss) before cumulative effect of change in

accounting principle and taxes(2) ................ $7,191 $3,543 $4,196 $2,888 $(1,021)

Adjustments:

Minority interest in the income of subsidiaries with

fixed charges ............................ 8 4 12 15 7

Undistributed (earnings) loss of equity method

investees ............................... (8) (2) (2) 22 46

Fixed charges ............................. 746 809 687 710 439

$7,937 $4,354 $4,893 $3,635 $ (529)

Fixed charges:

Total interest expense, including interest expense on

borrowings, amortization of debt discount and

premium on all indebtedness and other .......... $ 336 $ 377 $ 257 $ 304 $ 255

Interest included in rent ....................... 410 432 430 406 184

Total fixed charges ............................. $ 746 $ 809 $ 687 $ 710 $ 439

Ratio of earnings to fixed charges (excess of fixed charges

over earnings) .............................. 10.6x 5.4x 7.1x 5.1x $ (968)

(1) HP computed the ratio of earnings to fixed charges by dividing earnings (earnings before

cumulative effect of change in accounting principle and taxes, adjusted for fixed charges, minority

interest in the income of subsidiaries with fixed charges and undistributed earnings or loss of

equity method investees) by fixed charges for the periods indicated. Fixed charges include

(i) interest expense on borrowings and amortization of debt discount or premium on all

indebtedness and other, and (ii) a reasonable approximation of the interest factor deemed to be

included in rental expense.

(2) HP restated earnings (loss) before cumulative effect of change in accounting principle and taxes

for the effects of adopting SFAS No. 145 ‘‘Rescission of FASB Statements No. 4, 44, and 64,

Amendment of FASB Statement No. 13, and Technical Corrections.’’ HP adopted SFAS No. 145

effective November 1, 2002.