Frontier Communications 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-36

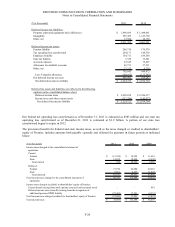

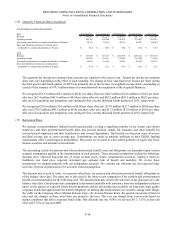

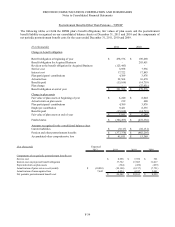

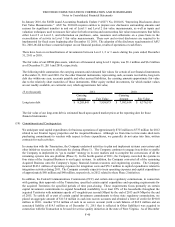

The amounts in accumulated other comprehensive income that have not yet been recognized as components of net

periodic benefit cost at December 31, 2011 and 2010 are as follows:

($ in thousands)

2011 2010 2011 2010

Net actuarial loss 574,998$ 349,298$ 82,841$ 64,598$

Prior service cost/(credit) 165 (34) (41,030) (51,229)

Total 575,163$ 349,264$ 41,811$ 13,369$

Pension Plan OPEB

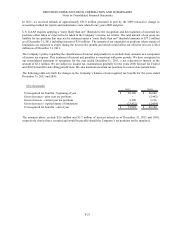

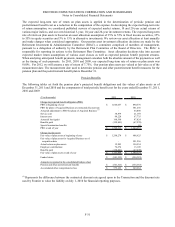

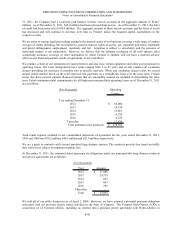

The amounts recognized as a component of accumulated comprehensive income for the years ended December 31,

2011 and 2010 are as follows:

($ in thousands) 2011 2010 2011 2010

Accumulated other comprehensive income at

beginning of year 349,264$ 374,157$ 13,369$ 21,554$

Net actuarial gain (loss) recognized during year (15,364) (27,393) (4,424) (4,919)

Prior service (cost)/credit recognized during year 199 199 10,198 8,158

Net actuarial loss (gain) occurring during year 241,064 2,301 22,668 16,506

Prior service cost (credit) occurring during year - - - (27,930)

Net amount recognized in comprehensive income

for the year 225,899 (24,893) 28,442 (8,185)

Accumulated other comprehensive income at end

of year 575,163$ 349,264$ 41,811$ 13,369$

Pension Plan OPEB

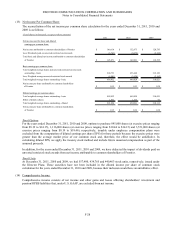

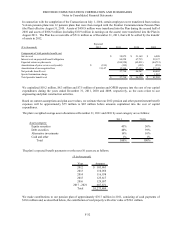

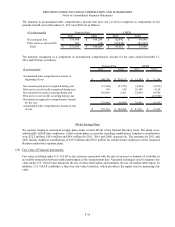

401(k) Savings Plans

We sponsor employee retirement savings plans under section 401(k) of the Internal Revenue Code. The plans cover

substantially all full-time employees. Under certain plans, we provide matching contributions. Employer contributions

were $22.2 million, $14.9 million and $4.4 million for 2011, 2010 and 2009, respectively. The amounts for 2011 and

2010 include employer contributions of $15.9 million and $10.6 million for certain former employees of the Acquired

Business under three separate plans.

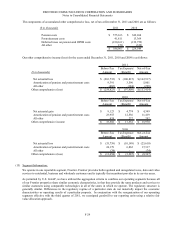

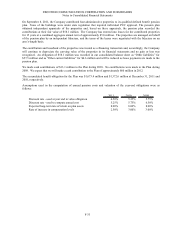

(18) Fair Value of Financial Instruments:

Fair value is defined under U.S. GAAP as the exit price associated with the sale of an asset or transfer of a liability in

an orderly transaction between market participants at the measurement date. Valuation techniques used to measure fair

value under U.S. GAAP must maximize the use of observable inputs and minimize the use of unobservable inputs. In

addition, U.S. GAAP establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair

value.