Frontier Communications 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-37

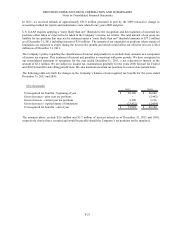

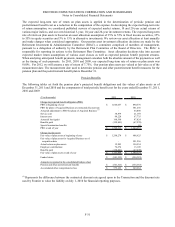

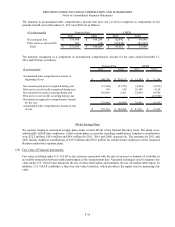

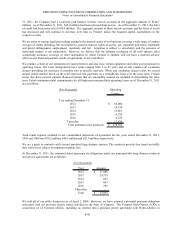

The following tables represent the Company’s pension plan assets measured at fair value on a recurring basis as of

December 31, 2011 and 2010:

Fair Value Measurements at December 31, 2011

Quoted Significant

Prices in Active Other Significant

Markets for Observable Unobservable

Identical Assets Inputs Inputs

($ in thousands) Total (Level 1) (Level 2) (Level 3)

Cash and Cash Equivalents $ 34,087 $ - $ 34,087 $ -

U.S. Government Obligations 120,802 - 120,802 -

Corporate and Other Obligations 323,075 - 323,075 -

Common Stock 251,776 251,776 - -

Commingled Funds 99,063 - 61,869 37,194

Common/Collective Trust Funds 8,606 - 8,606 -

Interest in Registered Investment Companies 253,752 83,667 170,085 -

Interest in Limited Partnerships 104,033 - - 104,033

Insurance Contracts 805 - 805 -

Other 141 - 141 -

Total investments, at fair value $ 1,196,140 $ 335,443 $ 719,470 $ 141,227

Receivable for Plan Assets of Acquired Business 51,634

Receivable for Earnings on Plan Assets of

Acquired Business 8,869

Interest and Dividends Receivable 2,835

Due from Broker for Securities Sold 30,085

Receivable Associated with Insurance Contract 7,727

Due to Broker for Securities Purchased (39,300)

Total Plan Assets, at Fair Value $ 1,257,990