Frontier Communications 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-35

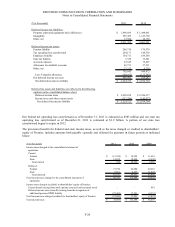

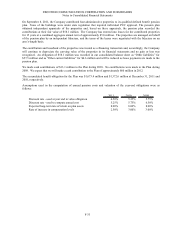

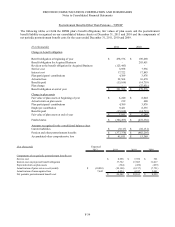

Assumptions used in the computation of annual OPEB costs and valuation of the year-end OPEB obligations were as

follows:

2011 2010 2009

Discount rate - used at year end to value obligation 4.50% - 4.75% 5.25% 5.75%

Discount rate - used to compute annual cost 5.25% 5.75% 6.50%

Expected long-term rate of return on plan assets 6.00% - 3.00% 6.00% 6.00%

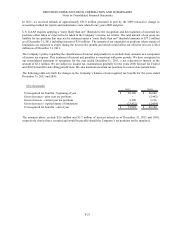

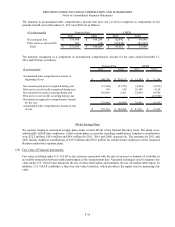

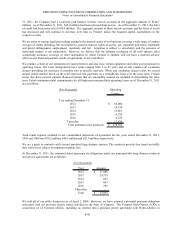

The OPEB plan’s expected benefit payments over the next 10 years are as follows:

($ in thousands)

Gross Medicare Part D

Year Benefits Subsidy Total

2012 13,211$ 372$ 12,839$

2013 14,575 446 14,129

2014 15,955 537 15,418

2015 17,630 635 16,995

2016 19,412 737 18,675

2017 - 2021 122,665 6,051 116,614

Total 203,448$ 8,778$ 194,670$

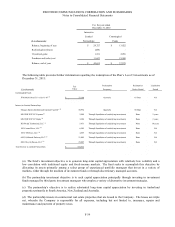

For purposes of measuring year-end benefit obligations, we used, depending on medical plan coverage for different

retiree groups, an 8.0% annual rate of increase in the per-capita cost of covered medical benefits, gradually decreasing

to 5% in the year 2017 and remaining at that level thereafter. The effect of a 1% increase in the assumed medical cost

trend rates for each future year on the aggregate of the service and interest cost components of the total postretirement

benefit cost would be $1.0 million and the effect on the accumulated postretirement benefit obligation for health

benefits would be $17.6 million. The effect of a 1% decrease in the assumed medical cost trend rates for each future

year on the aggregate of the service and interest cost components of the total postretirement benefit cost would be

$(0.9) million and the effect on the accumulated postretirement benefit obligation for health benefits would be $(15.8)

million.

In December 2003, the Medicare Prescription Drug Improvement and Modernization Act of 2003 (the Act) became

law. The Act introduced a prescription drug benefit under Medicare. It includes a federal subsidy to sponsors of retiree

health care benefit plans that provide a benefit that is at least actuarially equivalent to the Medicare Part D benefit. The

amount of the federal subsidy is based on 28% of an individual beneficiary’s annual eligible prescription drug costs

ranging between $250 and $5,000. We have determined that the Company-sponsored postretirement healthcare plans

that provide prescription drug benefits are actuarially equivalent to the Medicare Prescription Drug benefit. The impact

of the federal subsidy has been incorporated into the calculation.