Frontier Communications 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-21

Deferred Fee Plan, the Director Plans) and the 2009 Equity Incentive Plan (2009 EIP, and together with the 2000 EIP,

the EIP).

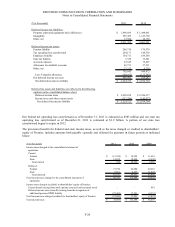

Our general policy is to issue shares from treasury upon the grant of restricted shares and exercise of options. At

December 31, 2011, there were 12,540,761 shares authorized for grant under these plans and 7,027,871 shares available

for grant under two of the plans. No further awards may be granted under three of the plans: the 1996 EIP, the 2000

EIP or the Deferred Fee Plan.

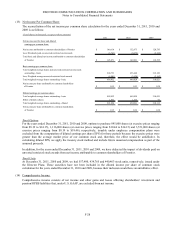

In connection with the Director Plans, compensation costs associated with the issuance of stock units was ($0.6)

million, $1.7 million and $0.7 million in 2011, 2010 and 2009, respectively. Cash compensation associated with the

Director Plans was $0.7 million in 2011, $0.5 million in 2010 and $0.6 million in 2009. These costs are recognized in

Other operating expenses.

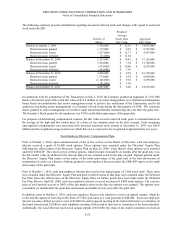

We have granted restricted stock awards to employees in the form of our common stock. The number of shares issued

as restricted stock awards during 2011, 2010 and 2009 were 1,734,000, 3,264,000 and 1,119,000, respectively. None of

the restricted stock awards may be sold, assigned, pledged or otherwise transferred, voluntarily or involuntarily, by the

employees until the restrictions lapse, subject to limited exceptions. The restrictions are time based. At December 31,

2011, 4,847,000 shares of restricted stock were outstanding. Compensation expense, recognized in Other operating

expenses, of $14.8 million, $12.8 million and $8.7 million, for the years ended December 31, 2011, 2010 and 2009,

respectively, has been recorded in connection with these grants.

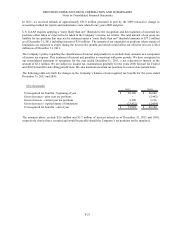

1996, 2000 and 2009 Equity Incentive Plans

Since the expiration dates of the 1996 EIP and the 2000 EIP on May 22, 2006 and May 14, 2009, respectively, no

awards have been or may be granted under the 1996 EIP and the 2000 EIP. Under the 2009 EIP, awards of our common

stock may be granted to eligible officers, management employees and non-management employees in the form of

incentive stock options, non-qualified stock options, SARs, restricted stock or other stock-based awards. As discussed

under the Non-Employee Directors’ Compensation Plans below, prior to May 25, 2006 non-employee directors

received an award of stock options under the 2000 EIP upon commencement of service.

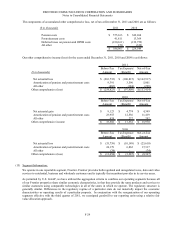

At December 31, 2011, there were 10,000,000 shares authorized for grant under the 2009 EIP and 5,265,147 shares

available for grant. No awards may be granted more than 10 years after the effective date (May 14, 2009) of the 2009

EIP plan. The exercise price of stock options and SARs under the 2009, 2000 and 1996 EIPs generally are equal to or

greater than the fair market value of the underlying common stock on the date of grant. Stock options are not ordinarily

exercisable on the date of grant but vest over a period of time (generally four years). Under the terms of the EIPs,

subsequent stock dividends and stock splits have the effect of increasing the option shares outstanding, which

correspondingly decrease the average exercise price of outstanding options.