Frontier Communications 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

35

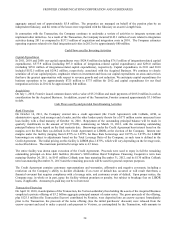

excess of the special cash payment and the initial purchasers’ discount received by the Company (approximately $53.0

million). In addition, the $125.5 million Transaction Escrow was returned to the Company.

Upon completion of the Transaction, we entered into a supplemental indenture with The Bank of New York Mellon, as

Trustee, pursuant to which we assumed the obligations under the senior notes.

The senior notes consist of $500.0 million aggregate principal amount of Senior Notes due 2015 (the 2015 Notes), $1.1

billion aggregate principal amount of Senior Notes due 2017 (the 2017 Notes), $1.1 billion aggregate principal amount of

Senior Notes due 2020 (the 2020 Notes) and $500.0 million aggregate principal amount of Senior Notes due 2022 (the 2022

Notes).

The 2015 Notes have an interest rate of 7.875% per annum, the 2017 Notes have an interest rate of 8.25% per annum, the

2020 Notes have an interest rate of 8.50% per annum and the 2022 Notes have an interest rate of 8.75% per annum. The

Senior Notes were issued at a price equal to 100% of their face value. In the third quarter of 2010, we completed an exchange

offer for the privately placed Senior Notes for registered notes.

Upon completion of the Transaction, we also assumed additional debt of $250.0 million, including $200.0 million aggregate

principal amount of 6.73% Senior Notes due February 15, 2028 and $50.0 million aggregate principal amount of 8.40%

Senior Notes due October 15, 2029.

Other Debt Financings

On October 1, 2009, we completed a registered offering of $600.0 million aggregate principal amount of 8.125% senior

unsecured notes due 2018. The issue price was 98.441% of the principal amount of the notes, and we received net proceeds

of approximately $578.7 million from the offering after deducting underwriting discounts and offering expenses. We used

the net proceeds from the offering, together with cash on hand (including cash proceeds from our April 2009 debt offering

described below), to finance a cash tender offer for our outstanding 9.250% Senior Notes due 2011 (the 2011 Notes) and our

outstanding 6.250% Senior Notes due 2013 (the 2013 Notes), as described below.

On April 9, 2009, we completed a registered offering of $600.0 million aggregate principal amount of 8.25% senior

unsecured notes due 2014. The issue price was 91.805% of the principal amount of the notes. We received net proceeds of

approximately $538.8 million from the offering after deducting underwriting discounts and offering expenses. We used the

net proceeds from the offering to repurchase outstanding debt, as described below.

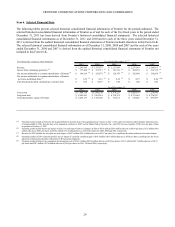

Debt Reduction

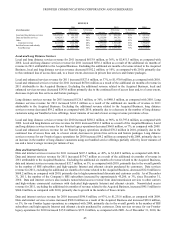

In 2011, we retired an aggregate principal amount of $552.4 million of debt, consisting of $551.4 million of senior unsecured

debt and $1.0 million of rural utilities service loan contracts.

We retired an aggregate principal amount of $7.2 million and $1,048.3 million of debt, consisting of $2.8 million and

$1,047.3 million of senior unsecured debt, as described in more detail below, and $4.4 million and $1.0 million of rural

utilities service loan contracts, in 2010 and 2009, respectively.

During the fourth quarter of 2009, the Company purchased and retired, in accordance with the terms of the tender offer

referred to above, approximately $564.4 million aggregate principal amount of the 2011 Notes and approximately $83.4

million aggregate principal amount of the 2013 Notes. The aggregate consideration for these debt repurchases was $701.6

million, which was financed with the proceeds of the October 2009 debt offering and a portion of the proceeds of the April

2009 debt offering, each as described above. The repurchases in the tender offer resulted in a loss on the early retirement of

debt of approximately $53.7 million, which we recognized in the fourth quarter of 2009.

In addition to the debt tender offer, we used $388.9 million of the April 2009 debt offering proceeds to repurchase in 2009

$396.7 million principal amount of debt, consisting of $280.8 million of the 2011 Notes, $54.1 million of our 7.875% Senior

Notes due January 15, 2027, $35.9 million of the 2013 Notes, $16.0 million of our 7.125% Senior Notes due March 15, 2019

and $9.9 million of our 6.80% Debentures due August 15, 2026. An additional $7.8 million net gain was recognized and

included in Other income (loss), net in our consolidated statements of operations for the year ended December 31, 2009 as a

result of these other debt repurchases.