Frontier Communications 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-17

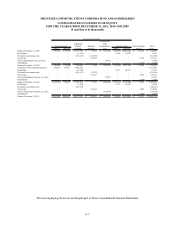

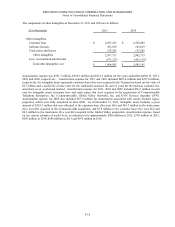

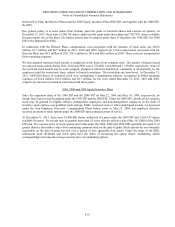

Additional information regarding our Senior Unsecured Debt at December 31, 2011 and 2010 is as follows:

2011 2010

Principal Interest Principal Interest

($ in thousands) Outstanding Rate Outstanding Rate

Senior Notes:

Due 5/15/2011 $ - - $ 76,089 9.250%

Due 10/24/2011 - - 200,000 6.270%

Due 12/31/2012 - - 144,000 1.688% (Variable)

Due 1/15/2013 580,724 6.250% 580,724 6.250%

Due 12/31/2013 - - 131,288 2.063% (Variable)

Due 5/1/2014 600,000 8.250% 600,000 8.250%

Due 3/15/2015 300,000 6.625% 300,000 6.625%

Due 4/15/2015 500,000 7.875% 500,000 7.875%

Due 10/14/2016 575,000 3.175% (Variable) - -

Due 4/15/2017 1,100,000 8.250% 1,100,000 8.250%

Due 10/1/2018 600,000 8.125% 600,000 8.125%

Due 3/15/2019 434,000 7.125% 434,000 7.125%

Due 4/15/2020 1,100,000 8.500% 1,100,000 8.500%

Due 4/15/2022 500,000 8.750% 500,000 8.750%

Due 1/15/2027 345,858 7.875% 345,858 7.875%

Due 2/15/2028 200,000 6.730% 200,000 6.730%

Due 10/15/2029 50,000 8.400% 50,000 8.400%

Due 8/15/2031 945,325 9.000% 945,325 9.000%

7,830,907 7,807,284

Debentures:

Due 11/1/2025 138,000 7.000% 138,000 7.000%

Due 8/15/2026 1,739 6.800% 1,739 6.800%

Due 10/1/2034 628 7.680% 628 7.680%

Due 7/1/2035 125,000 7.450% 125,000 7.450%

Due 10/1/2046 193,500 7.050% 193,500 7.050%

458,867 458,867

Subsidiary Senior

Notes due 12/1/2012 36,000 8.050% 36,000 8.050%

Total $ 8,325,774 7.93% $ 8,302,151 8.04%

On October 14, 2011, the Company entered into a credit agreement (the Credit Agreement) with CoBank, ACB, as

administrative agent, lead arranger and a lender, and the other lenders party thereto for a $575 million senior unsecured

term loan facility with a final maturity of October 14, 2016. Repayment of the outstanding principal balance will be

made in quarterly installments in the amount of $14,375,000, commencing on March 31, 2012, with the remaining

outstanding principal balance to be repaid on the final maturity date. Borrowings under the Credit Agreement bear

interest based on the margins over the Base Rate (as defined in the Credit Agreement) or LIBOR, at the election of the

Company. Interest rate margins under the facility (ranging from 0.875% to 2.875% for Base Rate borrowings and

1.875% to 3.875% for LIBOR borrowings) are subject to adjustments based on the Total Leverage Ratio of the

Company, as such term is defined in the Credit Agreement. The initial pricing on this facility is LIBOR plus 2.875%,

which will vary depending on the leverage ratio, as described above. The maximum permitted leverage ratio is 4.5

times.