Frontier Communications 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-31

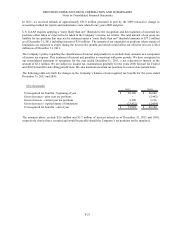

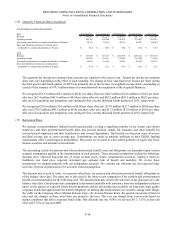

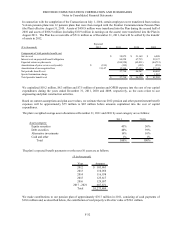

The expected long-term rate of return on plan assets is applied in the determination of periodic pension and

postretirement benefit cost as a reduction in the computation of the expense. In developing the expected long-term rate

of return assumption, we considered published surveys of expected market returns, 10 and 20 year actual returns of

various major indices, and our own historical 5-year, 10-year and 20-year investment returns. The expected long-term

rate of return on plan assets is based on an asset allocation assumption of 35% to 55% in fixed income securities, 35%

to 55% in equity securities and 5% to 15% in alternative investments. We review our asset allocation at least annually

and make changes when considered appropriate. Our pension asset investment allocation decisions are made by the

Retirement Investment & Administration Committee (RIAC), a committee comprised of members of management,

pursuant to a delegation of authority by the Retirement Plan Committee of the Board of Directors. The RIAC is

responsible for reporting its actions to the Retirement Plan Committee. Asset allocation decisions take into account

expected market return assumptions of various asset classes as well as expected pension benefit payment streams.

When analyzing anticipated benefit payments, management considers both the absolute amount of the payments as well

as the timing of such payments. In 2011, 2010 and 2009, our expected long-term rate of return on plan assets was

8.00%. For 2012, we will assume a rate of return of 7.75%. Our pension plan assets are valued at fair value as of the

measurement date. The measurement date used to determine pension and other postretirement benefit measures for the

pension plan and the postretirement benefit plan is December 31.

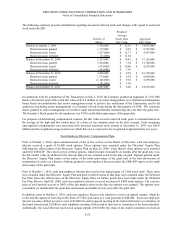

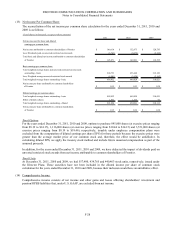

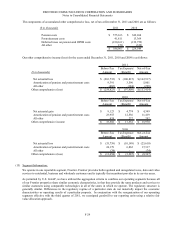

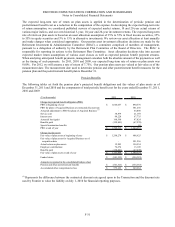

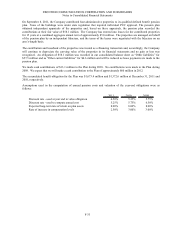

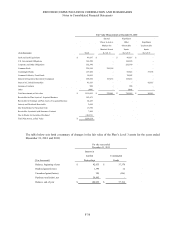

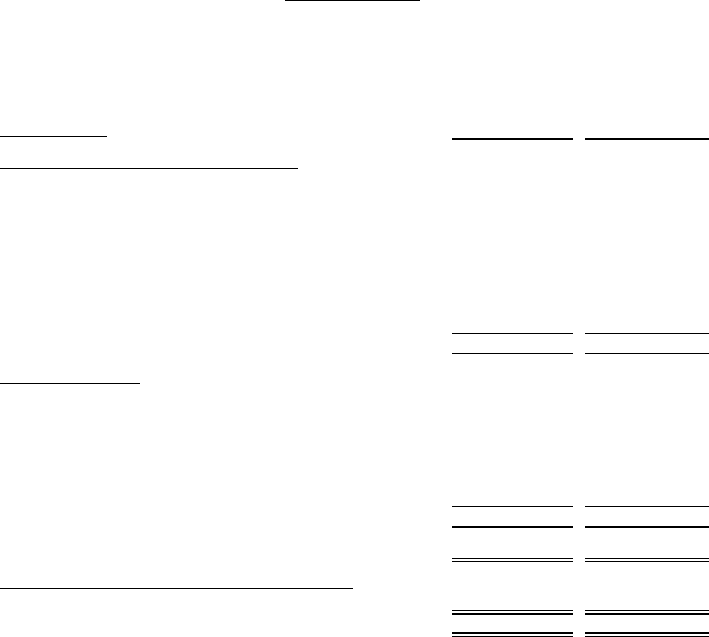

Pension Benefits

The following tables set forth the pension plan’s projected benefit obligations and fair values of plan assets as of

December 31, 2011 and 2010 and the components of total periodic benefit cost for the years ended December 31, 2011,

2010 and 2009:

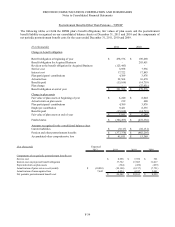

($ in thousands) 2011 2010

Change in projected benefit obligation (PBO)

PBO at beginning of year 1,644,657$ 890,576$

PBO for plans of Acquired Business at contracted discount rate - 581,256

Actuarial adjustment to PBO for plans of Acquired Business

(1)

- 64,098

Service cost 38,879 21,169

Interest cost 84,228 67,735

Actuarial loss/(gain) 160,390 87,024

Benefits paid (128,841) (67,270)

Special termination benefits - 69

PBO at end of year 1,799,313$ 1,644,657$

Change in plan assets

Fair value of plan assets at beginning of year 1,290,274$ 608,625$

Fair value of plan assets for Acquired Business as of

acquisition date - 581,256

Actual return on plan assets 19,883 154,554

Employer contributions 76,674 13,109

Benefits paid (128,841) (67,270)

Fair value of plan assets at end of year 1,257,990$ 1,290,274$

Funded status (541,323)$ (354,383)$

Amounts recognized in the consolidated balance sheet

Pension and other postretirement benefits (541,323)$ (354,383)$

Accumulated other comprehensive loss 575,163$ 349,264$

(1) Represents the difference between the contracted discount rate agreed upon in the Transaction and the discount rate

used by Frontier to value the liability on July 1, 2010 for financial reporting purposes.