Frontier Communications 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-26

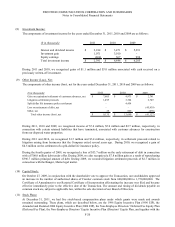

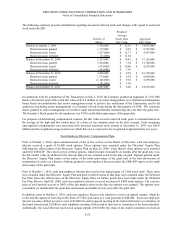

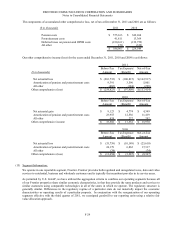

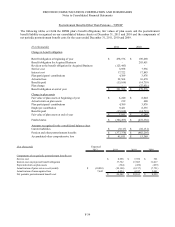

($ in thousands) 2011 2010

Deferred income tax liabilities:

Property, plant and equipment basis differences 1,896,666$ 1,448,061$

Intangibles 997,455 1,145,760

Other, net 17,584 10,170

2,911,705 2,603,991

Deferred income tax assets:

Pension liability 246,714 176,579

Tax operating loss carryforward 294,171 148,338

Employee benefits 154,711 189,558

State tax liability 7,358 13,241

Accrued expenses 27,645 75,407

Allowance for doubtful accounts 42,733 37,511

Other, net 22,313 4,238

795,645 644,872

Less: Valuation allowance (108,662) (115,585)

Net deferred income tax asset 686,983 529,287

Net deferred income tax liabilit

y

2,224,722$ 2,074,704$

Deferred tax assets and liabilities are reflected in the following

captions on the consolidated balance sheet:

Deferred income taxes 2,458,018$ 2,220,677$

Income taxes and other current assets (233,296) (145,973)

Net deferred income tax liability 2,224,722$ 2,074,704$

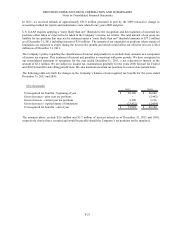

Our federal net operating loss carryforward as of December 31, 2011 is estimated as $503 million and our state tax

operating loss carryforward as of December 31, 2011 is estimated at $1.9 billion. A portion of our state loss

carryforward begins to expire in 2012.

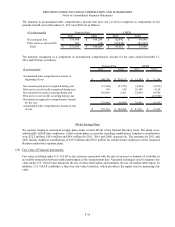

The provision (benefit) for Federal and state income taxes, as well as the taxes charged or credited to shareholders’

equity of Frontier, includes amounts both payable currently and deferred for payment in future periods as indicated

below:

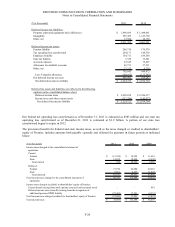

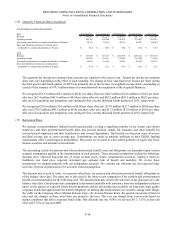

($ in thousands) 2011 2010 2009

Income taxes charged to the consolidated statement of

operations:

Current:

Federal (13,320)$ 18,302$ 11,618$

State 14,252 10,260 (2,630)

Total current 932 28,562 8,988

Deferred:

Federal 77,750 82,080 49,916

State 9,661 4,357 11,024

Total deferred 87,411 86,437 60,940

Total income taxes charged to the consolidated statement of 88,343 114,999 69,928

operations

Income taxes charged (credited) to shareholders' equity of Frontier:

Current benefit arising from stock options exercised and restricted stock - - 881

Deferred income taxes (benefits) arising from the recognition of

additional pension/OPEB liability (97,409) 17,501 (4,353)

Total income taxes charged (credited) to shareholders' equity of Frontier (97,409) 17,501 (3,472)

Total income taxes (9,066)$ 132,500$ 66,456$