Frontier Communications 2011 Annual Report Download - page 20

Download and view the complete annual report

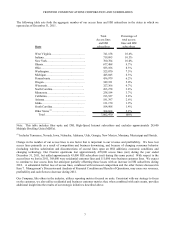

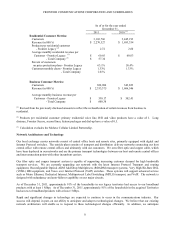

Please find page 20 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

17

provide services. New labor agreements or the renewal of existing agreements may impose significant new costs on us,

which could adversely affect our financial condition and results of operations in the future.

If we are unable to hire or retain key personnel, we may be unable to operate our business successfully.

Our success will depend in part upon the continued services of our management. We cannot guarantee that our

key personnel will not leave or compete with us. The loss, incapacity or unavailability for any reason of key members of

our management team could have a material impact on our business. In addition, our financial results and our ability to

compete will suffer should we become unable to attract, integrate or retain other qualified personnel in the future.

Our efforts to integrate our legacy business and the Acquired Business may not be successful.

The acquisition of the Acquired Business was the largest and most significant acquisition we have undertaken.

Our management has been and will continue to be required to devote a significant amount of time and attention to the

process of integrating the operations of our legacy business and the Acquired Business, which may decrease the time

management will have to serve existing customers, attract new customers and develop new services or strategies. The size

and complexity of the Acquired Business and the use of our existing common support functions and systems to manage the

Acquired Business, if not managed successfully, may result in interruptions in our activities, a decrease in the quality of our

services, a deterioration in our employee and customer relationships, increased costs of integration and harm to our

reputation, all of which could have a material adverse effect on our business, financial condition and results of operations.

We may not realize the growth opportunities that we anticipated from the Transaction.

The benefits that we expect to achieve as a result of the acquisition of the Acquired Business will depend, in part,

on our ability to realize anticipated growth opportunities. Our success in realizing these growth opportunities and the timing

of this realization, depends on the successful integration of our legacy business and operations and the Acquired Business

and operations. Even if we are able to complete the integration of the businesses and operations successfully, this

integration may not result in the realization of the full benefits of the growth opportunities that we currently expect from

this integration. Moreover, we have incurred substantial expenses in connection with the integration of our legacy business

and the Acquired Business. Through December 31, 2011, we have incurred $440.3 million in integration expenses and

capital expenditures, and we anticipate that additional expenditures will be incurred in 2012 to complete the integration.

Accordingly, the benefits from the Transaction may be partially offset by costs incurred or delays in integrating the

businesses.

Regulatory authorities, in connection with their approval of the acquisition, imposed on us certain conditions

relating to our capital expenditures and business operations which may adversely affect our financial performance.

In connection with granting their approvals of the Transaction, the FCC and certain state regulatory commissions

specified certain capital expenditure and operating requirements for the acquired Territories for specified periods of time post-

closing. These requirements focus primarily on certain capital investment commitments to expand broadband availability to at

least 85% of the households throughout the acquired Territories with minimum speeds of 3 megabits per second (Mbps) by the

end of 2013 and 4 Mbps by the end of 2015. To satisfy all or part of certain capital investment commitments to three state

regulatory commissions, we placed an aggregate amount of $115.0 million in cash into escrow accounts and obtained a letter

of credit for $190.0 million in 2010. Another $72.4 million of cash in an escrow account (with a cash balance of $62.9 million

and an associated liability of $14.3 million as of December 31, 2011) was acquired in connection with the Transaction to be

used for service quality initiatives in the state of West Virginia. As of December 31, 2011, we had a restricted cash balance in

these escrow accounts in the aggregate amount of $144.7 million. As of such date, $43.0 million had been released from

escrow. As of December 31, 2011, the letter of credit has been reduced to $100.0 million.

In addition, in certain states, we are subject to operating restrictions such as rate caps (including maintenance of the

rates on residential and business products and the prices and terms of interconnection agreements with competitive local

exchange carriers and arrangements with carriers that, in each case, existed as of the time of the acquisition), continuation of

product bundle offerings that we offered before the Transaction, waiver of certain customer early termination fees and

restrictions on others, restrictions on caps on usage of broadband capacity, and certain minimum service quality standards for a

defined period of time (the failure of which to meet, in one state, will result in penalties, including cash management

limitations on certain of our subsidiaries in that one state). In one other state, our subsidiaries are subject to restrictions on the

amount of dividends that can be paid to the parent company for a period ending on June 30, 2014. We are also required to