Frontier Communications 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-33

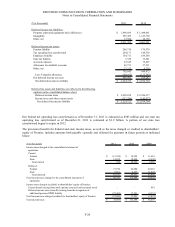

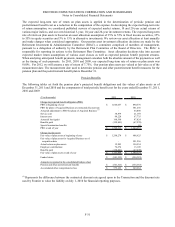

On September 8, 2011, the Company contributed four administrative properties to its qualified defined benefit pension

plan. None of the buildings were under state regulation that required individual PUC approval. The pension plan

obtained independent appraisals of the properties and, based on these appraisals, the pension plan recorded the

contributions at their fair value of $58.1 million. The Company has entered into leases for the contributed properties

for 15 years at a combined aggregate annual rent of approximately $5.8 million. The properties are managed on behalf

of the pension plan by an independent fiduciary, and the terms of the leases were negotiated with the fiduciary on an

arm’s-length basis.

The contribution and leaseback of the properties was treated as a financing transaction and, accordingly, the Company

will continue to depreciate the carrying value of the properties in its financial statements and no gain or loss was

recognized. An obligation of $58.1 million was recorded in our consolidated balance sheet as “Other liabilities” for

$57.5 million and as “Other current liabilities” for $0.6 million and will be reduced as lease payments are made to the

pension plan.

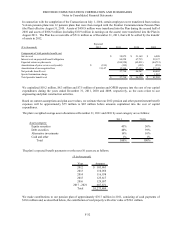

We made cash contributions of $13.1 million to the Plan during 2010. No contributions were made to the Plan during

2009. We expect that we will make a cash contribution to the Plan of approximately $60 million in 2012.

The accumulated benefit obligation for the Plan was $1,673.4 million and $1,372.6 million at December 31, 2011 and

2010, respectively.

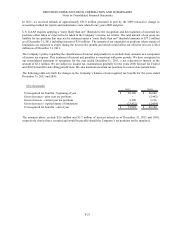

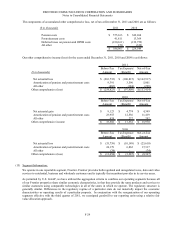

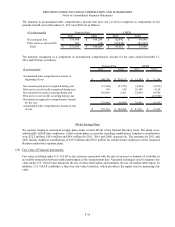

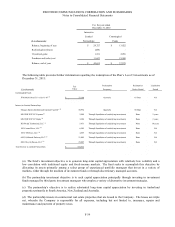

Assumptions used in the computation of annual pension costs and valuation of the year-end obligations were as

follows:

2011 2010 2009

Discount rate - used at year end to value obligation 4.50% 5.25% 5.75%

Discount rate - used to compute annual cost 5.25% 5.75% 6.50%

Expected long-term rate of return on plan assets 8.00% 8.00% 8.00%

Rate of increase in compensation levels 2.50% 3.00% 3.00%