Frontier Communications 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

48

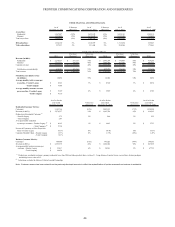

2009

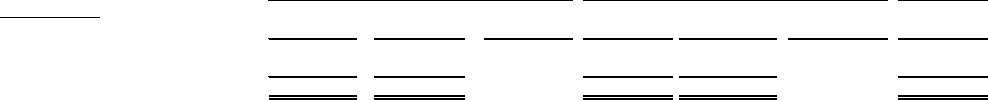

($ in thousands) $ Increase % Increase $ Increase % Increase

Amount (Decrease) (Decrease) Amount (Decrease) (Decrease) Amount

Wage and benefit expenses 1,093,017$ 289,294$ 36% 803,723$ 395,820$ 97% 407,903$

All other operating expenses 1,185,402 377,988 47% 807,414 434,220 116% 373,194

2,278,419$ 667,282$ 41% 1,611,137$ 830,040$ 106% 781,097$

2011 2010

OTHER OPERATING EXPENSES

Wage and benefit expenses

Wage and benefit expenses for 2011 increased $289.3 million, or 36%, to $1,093.0 million (including $15.7 million of

severance and early retirement costs in 2011 related to 318 employees), as compared to 2010. Wage and benefit expenses for

2011 increased $364.2 million as a result of the additional six months of expenses in 2011 attributable to the Acquired

Business. Wage and benefit expenses, excluding the additional six months of expenses related to the Acquired Business,

decreased $74.9 million, or 9%, to $728.8 million, as compared with 2010, primarily due to lower costs for compensation and

certain other benefits, including pension costs, as discussed below.

Wage and benefit expenses for 2010 increased $395.8 million, or 97%, to $803.7 million, as compared with 2009. Wage and

benefit expenses for 2010 increased $388.4 million as a result of the Acquired Business. Wage and benefit expenses for our

Frontier legacy operations increased $7.4 million, or 2%, to $415.3 million, as compared with 2009, primarily due to higher

compensation costs, as 2009 costs were reduced by the Company’s furlough plan, and 2010 reflects higher benefit costs,

primarily from restricted stock awards.

Pension costs for the Company are included in our wage and benefit expenses. Pension costs for 2011, 2010 and 2009 were

approximately $30.6 million, $38.0 million and $34.2 million, respectively. Pension costs include pension expense of $37.7

million, $46.3 million and $41.7 million, less amounts capitalized into the cost of capital expenditures of $7.1 million, $8.3

million and $7.5 million for 2011, 2010 and 2009, respectively.

In the third quarter of 2011, the Company contributed four administrative properties appraised at $58.1 million to its qualified

defined benefit pension plan. The Company is leasing back the properties from its pension plan for 15 years at a combined

aggregate annual rent of approximately $5.8 million. The properties are managed on behalf of the pension plan by an

independent fiduciary, and the terms of the leases were negotiated with the fiduciary on an arm’s-length basis.

In connection with the completion of the Transaction on July 1, 2010, certain employees were transferred from various

Verizon pension plans into 12 pension plans that were then merged with the Frontier Communications Pension Plan (the Plan)

effective August 31, 2010. Assets of $438.8 million and $106.9 million were transferred into the Plan during 2010 and 2011,

respectively. The Plan has a receivable of $51.6 million as of December 31, 2011 that will be settled by the transfer of assets

in 2012.

The Company’s pension plan assets have decreased from $1,290.3 million at December 31, 2010 to $1,258.0 million at

December 31, 2011, a decrease of $32.3 million, or 3%. This decrease is a result of ongoing benefit payments of $128.9

million, offset by $19.9 million of positive investment returns and cash and real property contributions of $76.7 million,

consisting of cash payments of $18.6 million and the contribution of real property with a fair value of $58.1 million.

Based on current assumptions and plan asset values, we estimate that our 2012 pension and other postretirement benefit

expenses (which were $58.3 million in 2011 before amounts capitalized into the cost of capital expenditures) will be

approximately $75 million to $85 million for Frontier before amounts capitalized into the cost of capital expenditures. We

made cash contributions to the Plan of $13.1 million during 2010. No contributions were made to Frontier’s pension plan

during 2009. We expect that we will make contributions to our pension plan of approximately $60 million in 2012.

All other operating expenses

All other operating expenses for 2011 increased $378.0 million, or 47%, to $1,185.4 million, as compared with 2010. All

other operating expenses for 2011 increased $439.5 million as a result of the additional six months of expenses in 2011

attributable to the Acquired Business. All other operating expenses, excluding the additional six months of expenses related

to the Acquired Business, decreased $61.5 million, or 8%, to $745.9 million, as compared with 2010, primarily due to $36.5

million in corporate costs allocated to the Acquired Business during the first six months of 2011, combined with lower

outside service fees, other taxes and marketing costs.