Frontier Communications 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-18

The entire facility was drawn upon execution of the Credit Agreement. Proceeds were used to repay in full the

remaining outstanding principal on three debt facilities (Frontier’s $200 million Rural Telephone Financing

Cooperative term loan maturing October 24, 2011, its $143 million CoBank term loan maturing December 31, 2012,

and its $130 million CoBank term loan maturing December 31, 2013) and the remaining proceeds will be used for

general corporate purposes.

The Credit Agreement contains customary representations and warranties, affirmative and negative covenants,

including a restriction on the Company’s ability to declare dividends if an event of default has occurred or will result

therefrom, a financial covenant that requires compliance with a leverage ratio, and customary events of default. Upon

proper notice, the Company may, in whole or in part, repay the facility without premium or penalty, but subject to

breakage fees on LIBOR loans, if applicable. Amounts pre-paid may not be re-borrowed.

We have a $750.0 million revolving credit facility. As of December 31, 2011, we had not made any borrowings

utilizing this facility. The terms of the credit facility are set forth in the Revolving Credit Agreement, dated as of

March 23, 2010, among the Company, the Lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative

Agent (the Revolving Credit Agreement). Associated facility fees under the credit facility will vary from time to time

depending on the Company’s credit rating (as defined in the Revolving Credit Agreement) and were 0.625% per annum

as of December 31, 2011. The credit facility is scheduled to terminate on January 1, 2014. During the term of the credit

facility, the Company may borrow, repay and reborrow funds, and may obtain letters of credit, subject to customary

borrowing conditions. Loans under the credit facility will bear interest based on the alternate base rate or the adjusted

LIBOR rate (each as determined in the Revolving Credit Agreement), at the Company’s election, plus a margin

specified in the Revolving Credit Agreement based on the Company’s credit rating. Letters of credit issued under the

credit facility will also be subject to fees that vary depending on the Company’s credit rating. The credit facility will be

available for general corporate purposes but may not be used to fund dividend payments.

We also have a $100.0 million unsecured letter of credit facility. The terms of the letter of credit facility are set forth in

a Credit Agreement, dated as of September 8, 2010, among the Company, the Lenders party thereto, and Deutsche

Bank AG, New York Branch (the Bank), as Administrative Agent and Issuing Bank (the Letter of Credit Agreement).

An initial letter of credit for $190.0 million was issued to the West Virginia Public Service Commission to guarantee

certain of our capital investment commitments in West Virginia in connection with the Transaction. The initial

commitments under the Letter of Credit Agreement expired on September 20, 2011, with the Bank exercising its option

to extend $100.0 million of the commitments to September 20, 2012. The Company is required to pay an annual facility

fee on the available commitment, regardless of usage. The covenants binding on the Company under the terms of the

Letter of Credit Agreement are substantially similar to those in the Company’s other credit facilities, including

limitations on liens, substantial asset sales and mergers, subject to customary exceptions and thresholds.

On April 12, 2010, in anticipation of the Transaction, the entity then holding the assets of the Acquired Business

completed a private offering for $3.2 billion aggregate principal amount of Senior Notes (the Senior Notes). The gross

proceeds of the offering, plus $125.5 million (the Transaction Escrow) contributed by Frontier, were deposited into an

escrow account. Immediately prior to the Transaction, the proceeds of the notes offering (less the initial purchasers’

discount) were released from the escrow account and used to make a special cash payment to Verizon, as contemplated

by the Transaction, with amounts in excess of the special cash payment and the initial purchasers’ discount received by

the Company (approximately $53.0 million). In addition, the $125.5 million Transaction Escrow was returned to the

Company.

Upon completion of the Transaction on July 1, 2010, we entered into a supplemental indenture with The Bank of New

York Mellon, as Trustee, pursuant to which we assumed the obligations under the Senior Notes. The Senior Notes

were recorded at their fair value on the date of acquisition, which was approximately $3.2 billion.

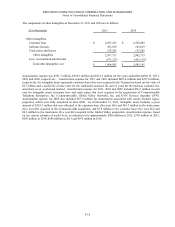

The Senior Notes consist of $500.0 million aggregate principal amount of Senior Notes due 2015 (the 2015 Notes),

$1.1 billion aggregate principal amount of Senior Notes due 2017 (the 2017 Notes), $1.1 billion aggregate principal

amount of Senior Notes due 2020 (the 2020 Notes) and $500.0 million aggregate principal amount of Senior Notes due

2022 (the 2022 Notes).

The 2015 Notes have an interest rate of 7.875% per annum, the 2017 Notes have an interest rate of 8.25% per annum,

the 2020 Notes have an interest rate of 8.50% per annum and the 2022 Notes have an interest rate of 8.75% per annum.