Frontier Communications 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-15

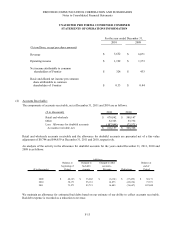

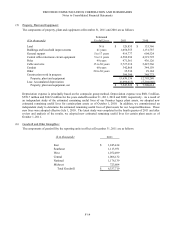

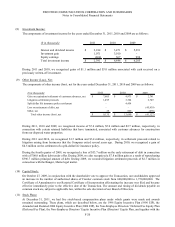

The components of other intangibles at December 31, 2011 and 2010 are as follows:

($ in thousands) 2011 2010

Other Intangibles:

Customer base $ 2,697,413 $ 2,702,409

Software licenses 105,019 105,019

Trade name and license 135,285 135,285

Other intangibles 2,937,717 2,942,713

Less: Accumulated amortization (973,212) (451,518)

Total other intangibles, net $ 1,964,505

$ 2,491,195

Amortization expense was $521.7 million, $294.1 million and $114.2 million for the years ended December 31, 2011,

2010 and 2009, respectively. Amortization expense for 2011 and 2010 included $465.4 million and $237.8 million,

respectively, for intangible assets (primarily customer base) that were acquired in the Transaction based on fair value of

$2.5 billion and a useful life of nine years for the residential customer list and 12 years for the business customer list,

amortized on an accelerated method. Amortization expense for 2011, 2010 and 2009 included $56.3 million in each

year for intangible assets (customer base and trade name) that were acquired in the acquisitions of Commonwealth

Telephone Enterprises, Inc. (Commonwealth), Global Valley Networks, Inc. and GVN Services (together GVN).

Amortization expense for 2009 also included $57.9 million for amortization associated with certain Frontier legacy

properties, which were fully amortized in June 2009. As of December 31, 2011, intangible assets includes a gross

amount of $263.5 million that was allocated to the customer base (five year life) and $10.3 million to the trade name

(five year life) acquired in the Commonwealth acquisition, and $7.0 million to the customer base (five year life) and

$0.3 million to the trade name (five year life) acquired in the Global Valley acquisition. Amortization expense, based

on our current estimate of useful lives, is estimated to be approximately $420 million in 2012, $330 million in 2013,

$285 million in 2014, $240 million in 2015 and $195 million in 2016.