Frontier Communications 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-27

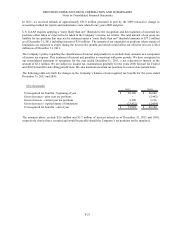

In 2011, we received refunds of approximately $53.9 million generated in part by the 2009 retroactive change in

accounting method for repairs and maintenance costs related to tax years 2008 and prior.

U.S. GAAP requires applying a “more likely than not” threshold to the recognition and derecognition of uncertain tax

positions either taken or expected to be taken in the Company’s income tax returns. The total amount of our gross tax

liability for tax positions that may not be sustained under a “more likely than not” threshold amounts to $37.5 million

as of December 31, 2011 including interest of $3.6 million. The amount of our uncertain tax positions whose statute of

limitations are expected to expire during the next twelve months and which would affect our effective tax rate is $8.4

million as of December 31, 2011.

The Company’s policy regarding the classification of interest and penalties is to include these amounts as a component

of income tax expense. This treatment of interest and penalties is consistent with prior periods. We have recognized in

our consolidated statement of operations for the year ended December 31, 2011, a net reduction in interest in the

amount of $2.1 million. We are subject to income tax examinations generally for the years 2008 forward for Federal

and 2005 forward for state filing jurisdictions. We also maintain uncertain tax positions in various state jurisdictions.

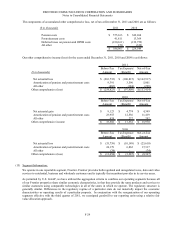

The following table sets forth the changes in the Company’s balance of unrecognized tax benefits for the years ended

December 31, 2011 and 2010:

($ in thousands)

2011 2010

Unrecognized tax benefits - beginning of year 49,180$ 56,860$

Gross decreases - prior year tax positions - (5,442)

Gross increases - current year tax positions 8,200 1,216

Gross decreases - expired statute of limitations (23,452) (3,454)

Unrecognized tax benefits - end of yea

r

33,928$ 49,180$

The amounts above exclude $3.6 million and $5.7 million of accrued interest as of December 31, 2011 and 2010,

respectively, that we have recorded and would be payable should the Company’s tax positions not be sustained.