Frontier Communications 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

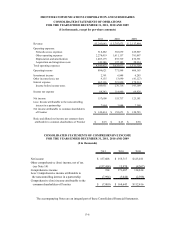

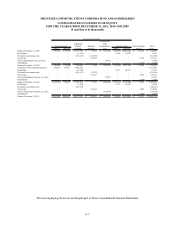

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-12

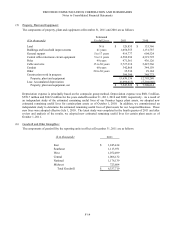

The allocation of the purchase price of the Acquired Business is based on the fair value of assets acquired and

liabilities assumed as of July 1, 2010, the effective date of the Transaction. Our assessment of fair value was

final as of June 30, 2011. In the fourth quarter of 2011, the Company recorded an immaterial non-cash revision

to the acquired liability balance for postretirement benefits other than pensions (OPEB) based upon corrected

information obtained regarding the treatment of certain plan provisions. The revision resulted in a decrease to the

acquired OPEB liability of $125,445, a decrease in goodwill of $78,754 and an increase in net deferred tax

liabilities of $46,691.

The final allocation of the purchase price presented below represents the effect of recording the final fair value of

assets acquired, liabilities assumed and related deferred income taxes as of the date of the Transaction, based on

the total transaction consideration of $5.4 billion. The following allocation of purchase price includes revisions

to the preliminary allocation that was reported as of December 31, 2010, primarily for goodwill, deferred taxes,

current liabilities and other liabilities.

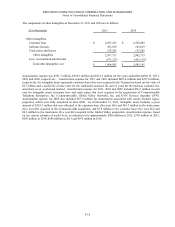

($ in thousands)

Total transaction consideration: $ 5,411,705

Current assets $ 454,513

Property, plant & equipment 4,407,676

Goodwill 3,695,397

Other intangibles – primarily customer list 2,532,200

Other noncurrent assets 75,092

Current liabilities (483,118)

Deferred income taxes (1,476,813)

Long-term debt (3,456,782)

Other liabilities (336,460)

Total net assets acquired $ 5,411,705

The fair value of the total consideration issued to acquire the Acquired Business amounted to $5.4 billion and

included $5.2 billion for the issuance of Frontier common shares and cash payments of $105.0 million. As a

result of the Transaction, Verizon stockholders received 678,530,386 shares of Frontier common stock.

Immediately after the closing of the Transaction, Verizon stockholders owned approximately 68.4% of the

combined company’s outstanding equity, and existing Frontier stockholders owned approximately 31.6% of the

combined company’s outstanding equity.

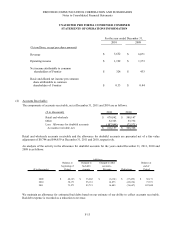

The following unaudited pro forma financial information presents the combined results of operations of Frontier

and the Acquired Business as if the Transaction had occurred as of January 1, 2009. The pro forma information is

not necessarily indicative of what the financial position or results of operations actually would have been had the

Transaction been completed as of January 1, 2009. In addition, the unaudited pro forma financial information is

not indicative of, nor does it purport to project, the future financial position or operating results of Frontier. The

unaudited pro forma financial information excludes acquisition and integration costs and does not give effect to

any estimated and potential cost savings or other operating efficiencies that could result from the Transaction.