Frontier Communications 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

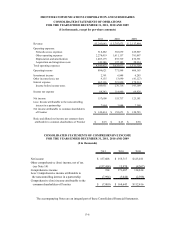

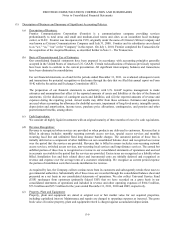

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-13

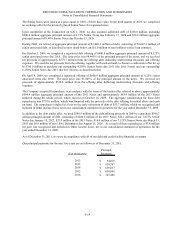

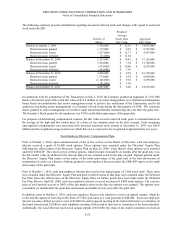

UNAUDITED PRO FORMA CONDENSED COMBINED

STATEMENTS OF OPERATIONS INFORMATION

For the year ended December 31,

2010 2009

($ in millions, except per share amounts)

Revenue $ 5,652 $ 6,071

Operating income

$

1,192

$

1,373

Net income attributable to common

shareholders of Frontier

$

324

$

433

Basic and diluted net income per common

share attributable to common

shareholders of Frontier

$

0.33

$

0.44

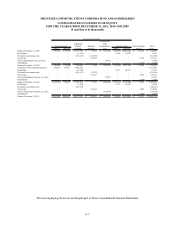

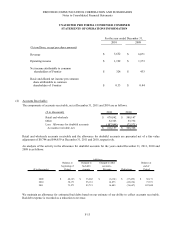

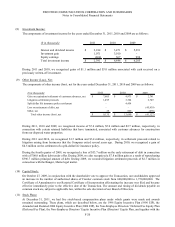

(4) Accounts Receivable:

The components of accounts receivable, net at December 31, 2011 and 2010 are as follows:

($ in thousands) 2011 2010

Retail and wholesale 670,842$ 588,147$

Other 52,363 53,732

Less: Allowance for doubtful accounts (107,048) (73,571)

Accounts receivable, net 616,157$ 568,308$

Retail and wholesale accounts receivable and the allowance for doubtful accounts are presented net of a fair value

adjustment of $9,794 and $44,859 at December 31, 2011 and 2010, respectively.

An analysis of the activity in the allowance for doubtful accounts for the years ended December 31, 2011, 2010 and

2009 is as follows:

Balance at Charged to Charged to other Balance at

beginning of bad debt accounts - end of

($ in thousands) Period expense Revenue Deductions Period

2009 40,125$ 33,682$ (6,181)$ (37,455)$ 30,171$

2010 30,171 55,161 14,873 (26,634) 73,571

2011 73,571 93,721 16,403 (76,647) 107,048

Additions

We maintain an allowance for estimated bad debts based on our estimate of our ability to collect accounts receivable.

Bad debt expense is recorded as a reduction to revenue.