Frontier Communications 2011 Annual Report Download - page 19

Download and view the complete annual report

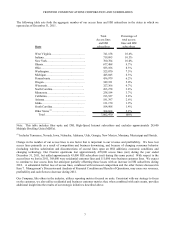

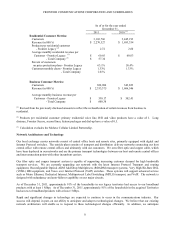

Please find page 19 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

16

We may be unable to grow our revenues and cash flows despite the initiatives we have implemented.

We must produce adequate revenues and cash flows that, when combined with funds available under our revolving

credit facility, will be sufficient to service our debt, fund our capital expenditures, pay our taxes, fund our pension and other

employee benefit obligations and pay dividends pursuant to our dividend policy. We have identified some potential areas

of opportunity and implemented several growth initiatives, including increasing marketing promotions and related

expenditures and launching new products and services with a focus on areas that are growing or demonstrate meaningful

demand, such as wireline and wireless HSI, satellite video products, and the Frontier Secure suite of products, which

includes computer technical support. We cannot assure you that these opportunities will be successful or that these

initiatives will improve our financial position or our results of operations.

Weak economic conditions may decrease demand for our services or necessitate increased discounts.

We could be adversely impacted if current economic conditions or their effects continue. Downturns in the

economy and competition in our markets could cause some of our customers to reduce or eliminate their purchases of our

basic and enhanced services, HSI and video services and make it difficult for us to obtain new customers. In addition, if

current economic conditions continue, our customers may delay or discontinue payment for our services or seek more

competitive pricing from other service providers, or we may be required to offer increased discounts in order to retain our

customers.

Disruption in our networks, infrastructure and information technology may cause us to lose customers and

incur additional expenses.

To attract and retain customers, we must provide reliable service. Some of the risks to our networks, infrastructure

and information technology include physical damage, security breaches, capacity limitations, power surges or outages,

software defects and other disruptions beyond our control, such as natural disasters and acts of terrorism. From time to

time in the ordinary course of business, we experience short disruptions in our service due to factors such as cable damage,

theft of our equipment, inclement weather and service failures of our third-party service providers. We could experience

more significant disruptions in the future. We could also face disruptions due to capacity limitations if changes in our

customers’ usage patterns for our HSI services result in a significant increase in capacity utilization, such as through

increased usage of video or peer-to-peer file sharing applications. Disruptions may cause interruptions in service or

reduced capacity for customers, either of which could cause us to lose customers and incur additional expenses, and thereby

adversely affect our business, revenues and cash flows.

Our business is sensitive to the creditworthiness of our wholesale customers.

We have substantial business relationships with other telecommunications carriers for whom we provide service.

While bankruptcies of these carriers have not had a material adverse effect on our business in recent years, future

bankruptcies in the industry could result in the loss of significant customers by us, as well as cause more price competition

and uncollectible accounts receivable. Such bankruptcies may be more likely in the future if current economic conditions

continue through 2012 or beyond. As a result, our revenues and results of operations could be materially and adversely

affected.

A significant portion of our workforce is represented by labor unions and is therefore subject to collective

bargaining agreements; if we are unable to enter into new agreements or renew existing agreements before they expire,

our workers subject to collective bargaining agreements could engage in strikes or other labor actions that could

materially disrupt our ability to provide services to our customers.

As of December 31, 2011, we had approximately 15,400 active employees. Approximately 10,000, or 65%, of

these employees were represented by unions and were therefore subject to collective bargaining agreements. Of the union

represented employees as of December 31, 2011, approximately 3,100, or 31%, are subject to collective bargaining

agreements that expire in 2012 and approximately 4,500, or 45%, are subject to collective bargaining agreements that

expire in 2013.

We cannot predict the outcome of negotiations of the collective bargaining agreements covering our employees.

If we are unable to reach new agreements or renew existing agreements, employees subject to collective bargaining

agreements may engage in strikes, work slowdowns or other labor actions, which could materially disrupt our ability to