Frontier Communications 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-19

The Senior Notes were issued at a price equal to 100% of their face value. In the third quarter of 2010, we completed

an exchange offer for the privately placed Senior Notes for registered notes.

Upon completion of the Transaction on July 1, 2010, we also assumed additional debt of $250.0 million, including

$200.0 million aggregate principal amount of 6.73% Senior Notes due February 15, 2028 and $50.0 million aggregate

principal amount of 8.40% Senior Notes due October 15, 2029.

During 2009, we retired an aggregate principal amount of $1,048.3 million of debt, consisting of $1,047.3 million of

senior unsecured debt, as described in more detail below, and $1.0 million of rural utilities service loan contracts.

On October 1, 2009, we completed a registered debt offering of $600.0 million aggregate principal amount of 8.125%

senior unsecured notes due 2018. The issue price was 98.441% of the principal amount of the notes, and we received

net proceeds of approximately $578.7 million from the offering after deducting underwriting discounts and offering

expenses. We used the net proceeds from the offering, together with cash on hand, to finance a cash tender offer for up

to $700.0 million to purchase our outstanding 9.250% Senior Notes due 2011 (the 2011 Notes) and our outstanding

6.250% Senior Notes due 2013 (the 2013 Notes), as described below.

On April 9, 2009, we completed a registered offering of $600.0 million aggregate principal amount of 8.25% senior

unsecured notes due 2014. The issue price was 91.805% of the principal amount of the notes. We received net

proceeds of approximately $538.8 million from the offering after deducting underwriting discounts and offering

expenses.

The Company accepted for purchase, in accordance with the terms of the tender offer referred to above, approximately

$564.4 million aggregate principal amount of the 2011 Notes and approximately $83.4 million of the 2013 Notes

tendered during the tender period, which expired on October 16, 2009. The aggregate consideration for these debt

repurchases was $701.6 million, which was financed with the proceeds of the debt offering described above and cash

on hand. The repurchases resulted in a loss on the early retirement of debt of $53.7 million, which we recognized and

included in Other income (loss), net in our consolidated statement of operations for the year ended December 31, 2009.

In addition to the debt tender offer, we used $388.9 million of the debt offering proceeds in 2009 to repurchase $396.7

million principal amount of debt, consisting of $280.8 million of the 2011 Notes, $54.1 million of our 7.875% Senior

Notes due January 15, 2027, $35.9 million of the 2013 Notes, $16.0 million of our 7.125% Senior Notes due March 15,

2019 and $9.9 million of our 6.80% Debentures due August 15, 2026. As a result of these repurchases, a $7.8 million

net gain was recognized and included in Other income (loss), net in our consolidated statement of operations for the

year ended December 31, 2009.

As of December 31, 2011, we were in compliance with all of our debt and credit facility financial covenants.

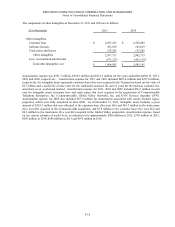

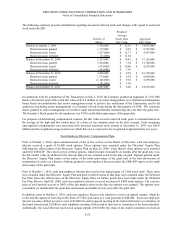

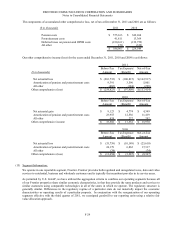

Our principal payments for the next five years are as follows as of December 31, 2011:

Principal

($ in thousands) Payments

2012 $ 94,016

2013 $ 638,767

2014 $ 658,017

2015 $ 858,049

2016 $ 345,466