Frontier Communications 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-41

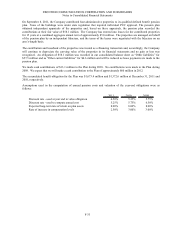

31, 2011, the Company had a restricted cash balance in these escrow accounts in the aggregate amount of $144.7

million. As of December 31, 2011, $43.0 million had been released from escrow. As of December 31, 2011, the letter

of credit had been reduced to $100.0 million. The aggregate amount of these escrow accounts and the letter of credit

has decreased and will continue to decrease over time as Frontier makes the required capital expenditures in the

respective states.

We are party to various legal proceedings arising in the normal course of our business covering a wide range of matters

or types of claims including, but not limited to, general contract, rights of access, tax, consumer protection, trademark

and patent infringement, employment, regulatory and tort. Litigation is subject to uncertainty and the outcome of

individual matters is not predictable. However, we believe that the ultimate resolution of all such matters, after

considering insurance coverage or other indemnities to which Frontier is entitled, will not have a material adverse

effect on our financial position, results of operations, or our cash flows.

We conduct certain of our operations in leased premises and also lease certain equipment and other assets pursuant to

operating leases. The lease arrangements have terms ranging from 1 to 99 years and several contain rent escalation

clauses providing for increases in monthly rent at specific intervals. When rent escalation clauses exist, we record

annual rental expense based on the total expected rent payments on a straight-line basis over the lease term. Certain

leases also have renewal options. Renewal options that are reasonably assured are included in determining the lease

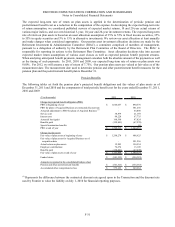

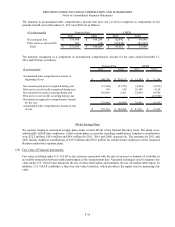

term. Future minimum rental commitments for all long-term noncancelable operating leases as of December 31, 2011

are as follows:

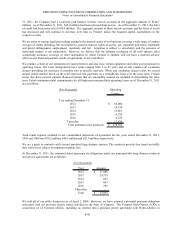

($ in thousands) Operating

Leases

Year ending December 31:

2012 66,000$

2013 18,156

2014 15,861

2015 6,726

2016 4,325

Thereafter 17,434

Total minimum lease payments 128,502$

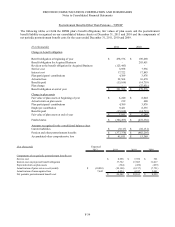

Total rental expense included in our consolidated statements of operations for the years ended December 31, 2011,

2010 and 2009 was $70.2 million, $48.5 million and $25.9 million, respectively.

We are a party to contracts with several unrelated long distance carriers. The contracts provide fees based on traffic

they carry for us subject to minimum monthly fees.

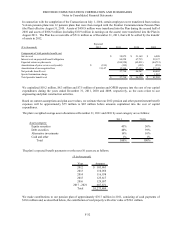

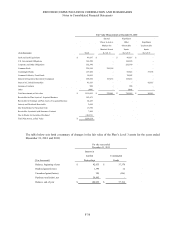

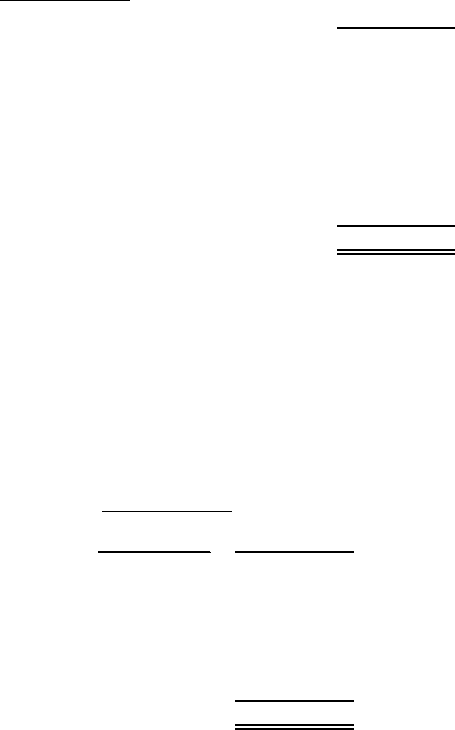

At December 31, 2011, the estimated future payments for obligations under our noncancelable long distance contracts

and service agreements are as follows:

($ in thousands)

Year Amount

2012 27,488$

2013 24,739

2014 603

2015 603

2016 259

Thereafter -

Total 53,692$

We sold all of our utility businesses as of April 1, 2004. However, we have retained a potential payment obligation

associated with our previous electric utility activities in the State of Vermont. The Vermont Joint Owners (VJO), a

consortium of 14 Vermont utilities, including us, entered into a purchase power agreement with Hydro-Quebec in