Frontier Communications 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

36

We may from time to time repurchase our debt in the open market, through tender offers, exchanges of debt securities, by

exercising rights to call or in privately negotiated transactions. We may also refinance existing debt or exchange existing debt

for newly issued debt obligations.

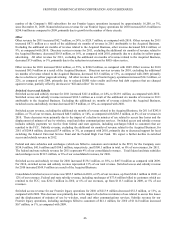

Credit Facility

We have a $750.0 million revolving credit facility. As of December 31, 2011, we had not made any borrowings utilizing this

facility. The terms of the credit facility are set forth in the Revolving Credit Agreement, dated as of March 23, 2010, among

the Company, the Lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent (the Revolving Credit

Agreement). Associated facility fees under the credit facility will vary from time to time depending on the Company’s credit

rating (as defined in the Revolving Credit Agreement) and were 0.625% per annum as of December 31, 2011. The credit

facility is scheduled to terminate on January 1, 2014. During the term of the credit facility, the Company may borrow, repay

and reborrow funds, and may obtain letters of credit, subject to customary borrowing conditions. Loans under the credit

facility will bear interest based on the alternate base rate or the adjusted LIBOR rate (each as determined in the Revolving

Credit Agreement), at the Company’s election, plus a margin specified in the Revolving Credit Agreement based on the

Company’s credit rating. Letters of credit issued under the credit facility will also be subject to fees that vary depending on

the Company’s credit rating. The credit facility will be available for general corporate purposes but may not be used to fund

dividend payments.

Letter of Credit Facility

We also have a $100.0 million unsecured letter of credit facility. The terms of the letter of credit facility are set forth in a

Credit Agreement, dated as of September 8, 2010, among the Company, the Lenders party thereto, and Deutsche Bank AG,

New York Branch (the Bank), as Administrative Agent and Issuing Bank (the Letter of Credit Agreement). An initial letter of

credit for $190.0 million was issued to the West Virginia Public Service Commission to guarantee certain of our capital

investment commitments in West Virginia in connection with the Transaction. The initial commitments under the Letter of

Credit Agreement expired on September 20, 2011, with the Bank exercising its option to extend $100.0 million of the

commitments to September 20, 2012. The Company is required to pay an annual facility fee on the available commitment,

regardless of usage. The covenants binding on the Company under the terms of the Letter of Credit Agreement are

substantially similar to those in the Company’s other credit facilities, including limitations on liens, substantial asset sales and

mergers, subject to customary exceptions and thresholds.

Covenants

The terms and conditions contained in our indentures, the Credit Agreement, the Revolving Credit Agreement and the Letter

of Credit Agreement include the timely payment of principal and interest when due, the maintenance of our corporate

existence, keeping proper books and records in accordance with U.S. GAAP, restrictions on the incurrence of liens on our

assets, and restrictions on asset sales and transfers, mergers and other changes in corporate control. We are not subject to

restrictions on the payment of dividends either by contract, rule or regulation, other than that imposed by the General

Corporation Law of the State of Delaware. However, we would be restricted under the Credit Agreement, the Revolving

Credit Agreement and the Letter of Credit Agreement from declaring dividends if an event of default occurred and was

continuing at the time or would result from the dividend declaration.

The Credit Agreement and the Revolving Credit Agreement each contain a maximum leverage ratio covenant. Under those

covenants, we are required to maintain a ratio of (i) total indebtedness minus cash and cash equivalents (including restricted

cash) in excess of $50.0 million to (ii) consolidated adjusted EBITDA (as defined in the agreements) over the last four

quarters no greater than 4.50 to 1. At December 31, 2011, the ratio of our net debt to adjusted operating cash flow (leverage

ratio) was 3.18 times.

The Credit Agreement, the Revolving Credit Agreement, the Letter of Credit Agreement and certain indentures for our senior

unsecured debt obligations limit our ability to create liens or merge or consolidate with other companies and our subsidiaries’

ability to borrow funds, subject to important exceptions and qualifications.

As of December 31, 2011, we were in compliance with all of our debt and credit facility covenants.

Dividends

We intend to pay regular quarterly dividends. Effective February 16, 2012, our Board of Directors has set the annual cash

dividend rate at $0.40 per share. Our ability to fund a regular quarterly dividend will be impacted by our ability to generate

cash from operations. The declarations and payment of future dividends will be at the discretion of our Board of Directors,