Frontier Communications 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

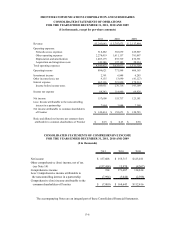

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-11

net income attributable to common shareholders of Frontier. Except when the effect would be antidilutive, diluted

net income per common share reflects the dilutive effect of the assumed exercise of stock options using the

treasury stock method at the beginning of the period being reported on.

(2) Recent Accounting Literature:

Fair Value Measurements

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU)

No. 2011-04 (ASU 2011-04), “Fair Value Measurements: Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (Accounting Standards Codification

(ASC) Topic 820). ASU 2011-04 changes the wording used to describe many of the requirements in U.S. GAAP

for measuring fair value and for disclosing information about fair value measurements to ensure consistency

between U.S. GAAP and IFRS. ASU 2011-04 also expands the disclosures for fair value measurements that are

estimated using significant unobservable (Level 3) inputs. This new guidance is to be applied prospectively, and

is effective for interim and annual periods beginning after December 15, 2011. We do not expect the adoption of

ASU 2011-04 to have a material impact on our financial position, results of operations or cash flows.

Presentation of Comprehensive Income

In June 2011, the FASB issued ASU No. 2011-05 (ASU 2011-05), “Comprehensive Income: Presentation of

Comprehensive Income,” (ASC Topic 220). ASU 2011-05 eliminates the option to report other comprehensive

income and its components in the statement of changes in equity. ASU 2011-05 requires that all non-owner

changes in stockholders’ equity be presented in either a single continuous statement of comprehensive income or

in two separate but consecutive statements. This new guidance is to be applied retrospectively, and is effective

for interim and annual periods beginning after December 15, 2011. In December 2011, the FASB issued ASU

No. 2011-12 that defers the effective date for amendments to the presentation of reclassifications of items out of

accumulated other comprehensive income in ASU 2011-05. We do not expect the adoption of ASU 2011-05 to

have a material impact on our financial position, results of operations or cash flows.

Testing Goodwill for Impairment

In September 2011, the FASB issued ASU No. 2011-08 (ASU 2011-08), “Intangibles-Goodwill and Other (ASC

Topic 350): Testing Goodwill for Impairment.” ASU 2011-08 permits an entity to first assess qualitative factors

to determine whether it is more likely than not (a likelihood of more than 50 percent) that the fair value of a

reporting unit is less than its carrying amount. After assessing qualitative factors, if an entity determines that it is

not more likely than not that the fair value of the reporting unit is less than its carrying amount, no further testing

is necessary. If an entity determines that it is more likely than not that the fair value of the reporting unit is less

than its carrying value, then the traditional two-step goodwill impairment test must be performed. While ASU

2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after

December 15, 2011, early adoption is permitted. The Company performed its annual impairment test during the

fourth quarter ending December 31, 2011. The Company adopted ASU 2011-08 during 2011 with no material

impact on our financial position, results of operations or cash flows.

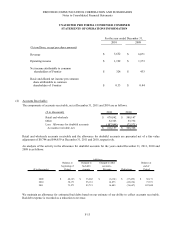

(3) The Transaction:

On July 1, 2010, Frontier acquired the defined assets and liabilities of the local exchange business and related

landline activities of Verizon Communications Inc. (Verizon) in Arizona, Idaho, Illinois, Indiana, Michigan,

Nevada, North Carolina, Ohio, Oregon, South Carolina, Washington, West Virginia and Wisconsin and in

portions of California bordering Arizona, Nevada and Oregon (collectively, the Territories), including Internet

access and long distance services and broadband video provided to designated customers in the Territories (the

Acquired Business). Frontier was considered the acquirer of the Acquired Business for accounting purposes.

We are accounting for our acquisition of approximately 4.0 million access lines from Verizon (the Transaction)

using the guidance included in ASC Topic 805. We incurred approximately $143.1 million, $137.1 million and

$28.3 million of acquisition and integration related costs in connection with the Transaction during the years

ended December 31, 2011, 2010 and 2009, respectively. Such costs are required to be expensed as incurred and

are reflected in “Acquisition and integration costs” in our consolidated statements of operations.