Frontier Communications 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

51

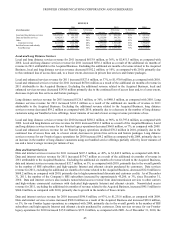

Income Tax Expense

Income tax expense for 2011 decreased $26.7 million, or 23%, to $88.3 million, as compared with 2010, primarily due to

lower pretax income, the reduction of deferred tax balances based on the application of enacted state tax statutes for $6.8

million and the net reversal of a reserve for uncertain tax positions for $8.6 million, partially offset by the impact of a $10.8

million charge resulting from the enactment on May 25, 2011 of the Michigan Corporate Income Tax that eliminated certain

future tax deductions.

The effective tax rate for 2011 was 35.9% as compared with 42.5% for 2010 and 36.2% for 2009.

Income tax expense for 2010 increased $45.1 million, or 64%, to $115.0 million as compared with 2009, primarily due to

higher pretax income as a result of the Acquired Business. During 2010, Frontier reduced certain deferred tax assets of

approximately $11.3 million related to Transaction costs which were not tax deductible. These costs were incurred to

facilitate the Transaction and as such had to be capitalized for tax purposes. The results for 2010 also include the impact of a

$4.1 million charge resulting from health care reform legislation associated with the passage of the Patient Protection and

Affordable Care Act and of the Health Care and Education Reconciliation Act of 2010 (the Acts), partially offset by a release

of $0.9 million in the reserve related to uncertain tax positions and the permanent difference on a split-dollar life insurance

policy settlement for $1.6 million. The health care reform legislation enacted in March 2010 under the Acts has eliminated the

tax deduction for the subsidy that the Company receives under Medicare Part D for prescription drug costs.

The amount of our uncertain tax positions whose statute of limitations are expected to expire during the next twelve months

and which would affect our effective tax rate is $8.4 million as of December 31, 2011.

We received refunds (net of cash taxes paid) of $33.1 million in cash taxes during 2011, as compared to the payment of $19.9

million in cash taxes during 2010. In 2011, we received refunds of approximately $53.9 million generated in part by the 2009

retroactive change in accounting method for repairs and maintenance costs related to tax years 2008 and prior. We expect

that our cash tax payments will be approximately $25 million for 2012.

Net income attributable to common shareholders of Frontier

Net income attributable to common shareholders of Frontier for 2011 was $149.6 million, or $0.15 per share, as compared to

$152.7 million, or $0.23 per share, in 2010 and $120.8 million, or $0.38 per share, in 2009. The change in basic and diluted

net income per share for 2010 and 2011 was primarily due to the increase in weighted average shares outstanding as a result

of the issuance of 678.5 million shares in connection with our acquisition of the Acquired Business.