Dollar General 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

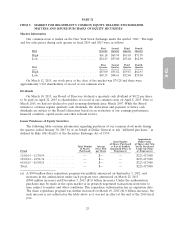

Market Information

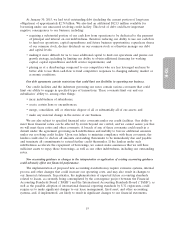

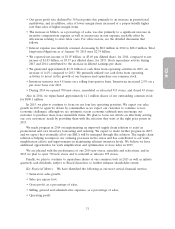

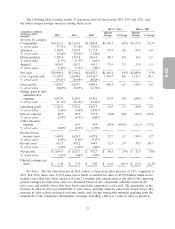

Our common stock is traded on the New York Stock Exchange under the symbol ‘‘DG.’’ The high

and low sales prices during each quarter in fiscal 2014 and 2013 were as follows:

First Second Third Fourth

2014 Quarter Quarter Quarter Quarter

High ................................ $61.18 $65.99 $65.10 $71.78

Low................................. $54.43 $53.00 $55.48 $62.50

First Second Third Fourth

2013 Quarter Quarter Quarter Quarter

High ................................ $53.00 $55.82 $59.87 $62.93

Low................................. $43.35 $48.61 $52.40 $55.08

On March 12, 2015, our stock price at the close of the market was $74.28 and there were

approximately 1,922 shareholders of record of our common stock.

Dividends

On March 10, 2015, our Board of Directors declared a quarterly cash dividend of $0.22 per share,

to be paid on April 22, 2015 to shareholders of record of our common stock on April 8, 2015. Prior to

March 2015, we had not declared or paid recurring dividends since March 2007. While the Board

intends to continue regular quarterly cash dividends, the declaration and payment of future cash

dividends are subject to the Board’s discretion based on an evaluation of our earnings performance,

financial condition, capital needs and other relevant factors.

Issuer Purchases of Equity Securities

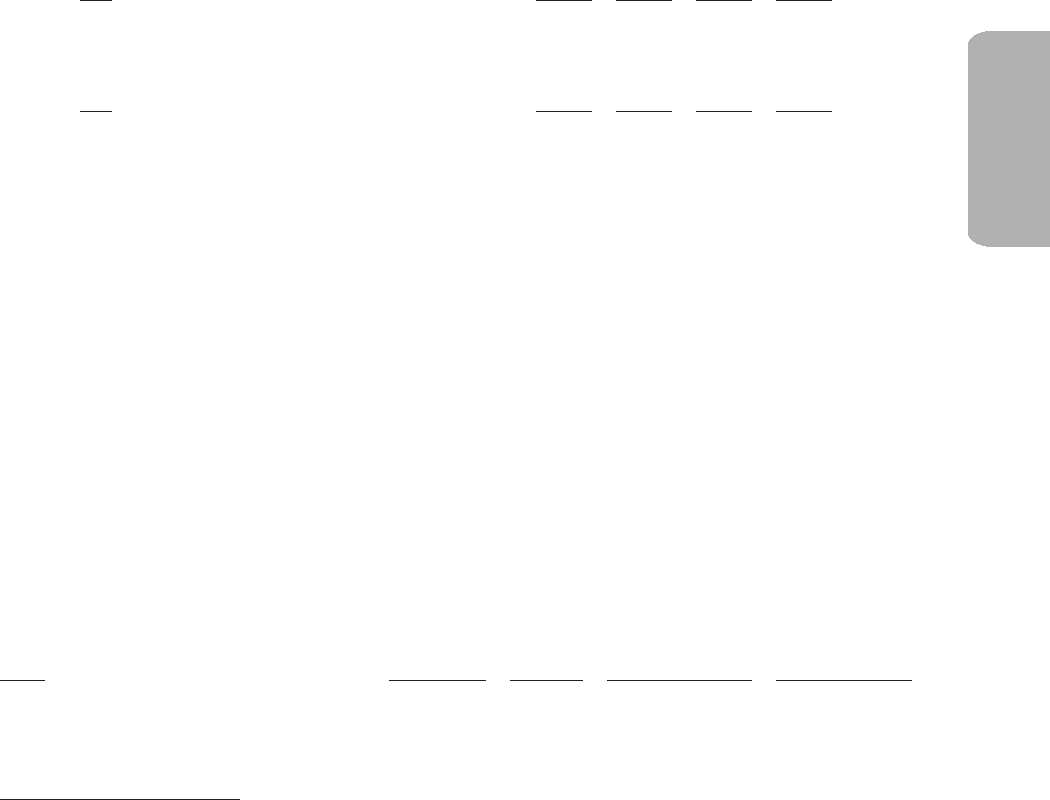

The following table contains information regarding purchases of our common stock made during

the quarter ended January 30, 2015 by or on behalf of Dollar General or any ‘‘affiliated purchaser,’’ as

defined by Rule 10b-18(a)(3) of the Securities Exchange Act of 1934:

Approximate

Total Number Dollar Value

of Shares Purchased of Shares that May

Total Number Average as Part of Publicly Yet Be Purchased

of Shares Price Paid Announced Plans or Under the Plans

Period Purchased per Share Programs(a) or Programs(a)

11/01/14 - 11/30/14 ................. — $— — $223,417,000

12/01/14 - 12/31/14 ................. — $— — $223,417,000

01/01/15 - 01/30/15 ................. — $— — $223,417,000

Total ........................... — $— — $223,417,000

(a) A $500 million share repurchase program was publicly announced on September 5, 2012, and

increases in the authorization under such program were announced on March 25, 2013

($500 million increase) and December 5, 2013 ($1.0 billion increase). Under the authorization,

purchases may be made in the open market or in privately negotiated transactions from time to

time subject to market and other conditions. This repurchase authorization has no expiration date.

The share repurchase program was further increased on March 10, 2015 ($1.0 billion increase), but

such increase is not reflected in the table above as it was not in effect at the end of the 2014 fiscal

year.

25