Dollar General 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

25MAR201519511740 25MAR201519511872

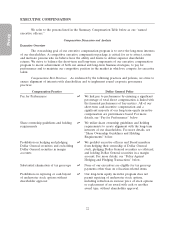

Compensation Practice Dollar General Policy

Annual compensation risk assessment ឡOur Compensation Committee performs at least

annually a risk assessment of our compensation

program.

Independent compensation consultant ឡThe Compensation Committee retains an independent

compensation consultant to advise the Compensation

Committee on the executive and non-employee

director compensation program and practices.

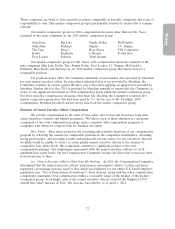

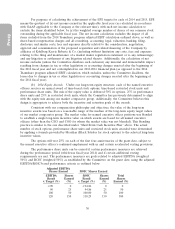

Pay for Performance. Consistent with our pay-for-performance philosophy, a significant

majority of our named executive officers’ target total direct compensation for 2014 was performance

based and exposed to fluctuations in the price of our common stock. In addition, our 2014 target total

direct compensation packages sought to reward both long-term and annual performance, as shown in

the charts below:

CEO Other NEOs

(Average)

Salary

14.05%

STI

18.27%

LTI

67.68%

Variable/At-Risk: 85.95%

Salary

29.38%

STI

20.30%

LTI

50.32%

Variable/At-Risk: 70.62%

STI—Short-Term Cash Incentive

LTI—Long-Term Equity Incentive

The results of the financial performance metrics used in connection with our 2014

performance-based compensation are as follows:

• Adjusted EBITDA was $2.175 billion (versus $2.09 billion in 2013) and Adjusted ROIC

was 19.50% (versus 19.89% in 2013), in each case as defined and calculated for purposes

of our outstanding performance share unit awards, resulting in the performance share units

granted in March 2014 being earned at 95.10% of target.

• Adjusted EBIT, as defined and calculated for purposes of our annual Teamshare bonus

program, was $1.795 billion (96.97% of the target) compared to $1.742 billion (94.2% of

target) in 2013, resulting in a 2014 Teamshare payout to participants at 84.84% of target.

• Adjusted EPS, as defined and calculated for purposes of Mr. Dreiling’s performance-based

restricted stock award granted in 2012, exceeded the 2014 target of $3.61 per share,

resulting in the vesting of the first tranche of such award.

Significant Compensation-Related Actions in 2014. We make various changes to our

compensation program in the normal course in order to remain competitive and further strengthen our

program in ways that support our shareholders’ interests. The most significant compensation-related

actions in 2014 pertaining to our named executive officers include:

23