Dollar General 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8. Commitments and contingencies

Leases

As of January 30, 2015, the Company was committed under operating lease agreements for most

of its retail stores. Many of the Company’s stores are subject to build-to-suit arrangements with

landlords which typically carry a primary lease term of up to 15 years with multiple renewal options.

The Company also has stores subject to shorter-term leases and many of these leases have renewal

options. Certain of the Company’s leased stores have provisions for contingent rentals based upon a

specified percentage of defined sales volume.

The land and buildings of the Company’s DCs in Fulton, Missouri and Indianola, Mississippi are

subject to operating lease agreements and the leased Ardmore, Oklahoma DC is subject to a financing

arrangement. The entities involved in the ownership structure underlying these leases meet the

accounting definition of a Variable Interest Entity (‘‘VIE’’). The Company is not the primary

beneficiary of these VIEs and, accordingly, has not included these entities in its consolidated financial

statements. Certain leases contain restrictive covenants that, individually, are not material to the

Company. As of January 30, 2015, the Company is not aware of any material violations of such

covenants.

In January 2014, the Company sold 233 store locations for cash and concurrent with the sale

transaction, the Company leased the properties back for a period of 15 years. The transaction resulted

in cash proceeds of approximately $281.6 million and a deferred gain of $67.2 million which is being

recognized as a reduction of rent expense over the 15-year initial lease term of the properties.

In January 1999, the Company sold its DC located in Ardmore, Oklahoma for cash and concurrent

with the sale transaction, the Company leased the property back for a period of 23 years. The

transaction is accounted for as a financing obligation rather than a sale as a result of, among other

things, the lessor’s ability to put the property back to the Company under certain circumstances. The

property and equipment, along with the related lease obligation associated with this transaction are

recorded in the consolidated balance sheets. In August 2007, the Company purchased a secured

promissory note (the ‘‘Ardmore Note’’) from an unrelated third party with a face value of $34.3 million

at the date of purchase which approximated the remaining financing obligation. The Ardmore Note

represents debt issued by the third party entity from which the Company leases the Ardmore DC and

therefore the Company holds the debt instrument pertaining to its lease financing obligation. Because a

legal right of offset exists, the Company is accounting for the Ardmore Note as a reduction of its

outstanding financing obligation in its consolidated balance sheets.

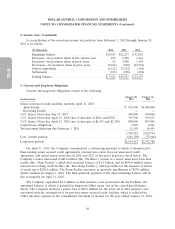

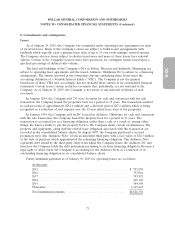

Future minimum payments as of January 30, 2015 for operating leases are as follows:

(In thousands)

2015 .................................................. $ 793,274

2016 .................................................. 751,044

2017 .................................................. 703,892

2018 .................................................. 648,120

2019 .................................................. 584,508

Thereafter ............................................. 3,145,663

Total minimum payments ................................... $6,626,501

73