Dollar General 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

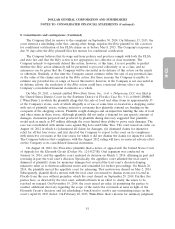

8. Commitments and contingencies (Continued)

On February 20, 2015, a lawsuit entitled Julie Sullivan v. Dolgen California and Does 1 through 100

(Case No. RG 15759417) (‘‘Sullivan’’) was filed in the Superior Court of the State of California for the

County of Alameda in which the plaintiff alleges that she and other similarly situated Dollar General

Market Store Managers in the State of California were improperly classified as exempt employees and

were not provided with meal and rest breaks and accurate wage statements in violation of California

law. The Sullivan plaintiff also alleges that she and other California store employees were not provided

with printed wage statements in violation of California law. Plaintiff seeks to recover unpaid wages

(including overtime pay), civil and statutory penalties, interest, injunctive relief, restitution, and

attorneys’ fees and costs. On March 2, 2015, Sullivan served notice to the Labor and Workforce

Development agency that she intends to proceed under the PAGA. The Company’s response to the

Sullivan complaint is due to be filed with the court on or before April 9, 2015.

The Company believes that its policies and practices comply with California law and that the

Varela, Pleasant II, and Sullivan actions are not appropriate for class or similar treatment. The

Company intends to vigorously defend these actions; however, at this time, it is not possible to predict

whether the Varela, Pleasant II, or Sullivan action ultimately will be permitted to proceed as a class, and

no assurances can be given that the Company will be successful in its defense of these actions on the

merits or otherwise. Similarly, at this time the Company cannot estimate either the size of any potential

class or the value of the claims asserted in the Varela, Pleasant II, or Sullivan action. For these reasons,

the Company is unable to estimate any potential loss or range of loss in these matters; however, if the

Company is not successful in its defense efforts, the resolution of any of these actions could have a

material adverse effect on the Company’s consolidated financial statements as a whole.

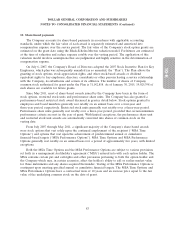

On July 2, 2013, a lawsuit entitled Rachel Buttry and Jennifer Peters v. Dollar General Corp. (Case

No. 3:13-cv-00652) (‘‘Buttry’’) was filed in the United States District Court for the Middle District of

Tennessee. The Buttry plaintiffs seek to proceed on a nationwide collective basis under the FLSA and

as a statewide class under Tennessee law on behalf of non-exempt store employees who allegedly were

not properly paid for certain breaks. The Buttry plaintiffs seek back wages (including overtime),

injunctive and declaratory relief, liquidated damages, compensatory and economic damages,

‘‘consequential’’ and ‘‘incidental’’ damages, pre-judgment and post-judgment interest, and attorneys’

fees and costs.

The Company filed its answer on August 7, 2013. The plaintiffs filed their motion for conditional

certification of their FLSA claims on December 5, 2013, to which the Company responded on

February 3, 2014. On April 4, 2014, the court denied plaintiffs’ certification motion. Plaintiffs filed a

motion for reconsideration or in the alternative for permission to seek interlocutory appeal in the

United States Court of Appeals for the Sixth Circuit on April 18, 2014. The court denied the plaintiffs’

motion on April 24, 2014.

The plaintiffs subsequently petitioned the Sixth Circuit for a writ of mandamus and asked the

district court to stay all deadlines in the underlying proceeding pending the Sixth Circuit’s ruling on the

writ. On October 23, 2014, the United States Court of Appeals for the Sixth Circuit denied plaintiff’s

petition for writ of mandamus.

The parties have reached a preliminary agreement, which must be submitted to and approved by

the court, to resolve this matter for an amount not material to the Company’s consolidated financial

statements as a whole. At this time, although probable, it is not certain that the court will approve the

settlement. However, even if the court does not approve the settlement on its current terms, the

79