Dollar General 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

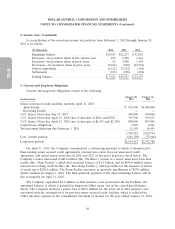

5. Current and long-term obligations (Continued)

The Senior Indenture also provides for events of default which, if any of them occurs, would

permit or require the principal of and accrued interest on the Senior Notes to become or to be

declared due and payable.

On July 15, 2012, the Company redeemed $450.7 million aggregate principal amount of

outstanding senior subordinated notes due 2017 at a premium, resulting in a pretax loss of

$29.0 million which is reflected in Other (income) expense in the consolidated statement of income for

the year ended February 1, 2013. The Company funded the redemption price for the senior

subordinated notes due 2017 with proceeds from the issuance of the 2017 Senior Notes.

Scheduled debt maturities, including capital lease obligations, for the Company’s fiscal years listed

below are as follows (in thousands): 2015—$101,158; 2016—$101,379; 2017—$601,290; 2018—

$1,025,892; 2019—$1,020; thereafter—$912,131.

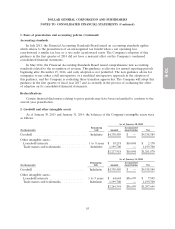

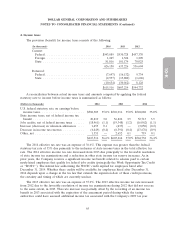

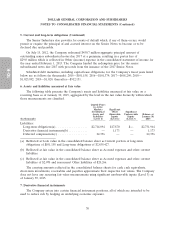

6. Assets and liabilities measured at fair value

The following table presents the Company’s assets and liabilities measured at fair value on a

recurring basis as of January 30, 2015, aggregated by the level in the fair value hierarchy within which

those measurements are classified.

Quoted Prices

in Active

Markets Significant

for Identical Other Significant

Assets and Observable Unobservable Balance at

Liabilities Inputs Inputs January 30,

(In thousands) (Level 1) (Level 2) (Level 3) 2015

Liabilities:

Long-term obligations(a) .................. $2,714,094 $17,870 $— $2,731,964

Derivative financial instruments(b) ........... — 1,173 — 1,173

Deferred compensation(c) ................. 22,336 — — 22,336

(a) Reflected at book value in the consolidated balance sheet as Current portion of long-term

obligations of $101,158 and Long-term obligations of $2,639,427.

(b) Reflected at fair value in the consolidated balance sheet as Accrued expenses and other current

liabilities.

(c) Reflected at fair value in the consolidated balance sheet as Accrued expenses and other current

liabilities of $2,070 and noncurrent Other liabilities of $20,266.

The carrying amounts reflected in the consolidated balance sheets for cash, cash equivalents,

short-term investments, receivables and payables approximate their respective fair values. The Company

does not have any recurring fair value measurements using significant unobservable inputs (Level 3) as

of January 30, 2015.

7. Derivative financial instruments

The Company enters into certain financial instrument positions, all of which are intended to be

used to reduce risk by hedging an underlying economic exposure.

70