Dollar General 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

• the implementation of share ownership holding requirements for our senior officers,

including the named executive officers, to further complement the existing share ownership

guidelines and enhance alignment with shareholders’ interests;

• an increase in the share ownership guideline for Mr. Vasos in light of his promotion to

Chief Operating Officer;

• the elimination from our employment agreements of the provisions providing for gross-up

payments on any excise taxes imposed under Section 280G of the Internal Revenue Code;

• the modification of the Teamshare bonus program to institute a financial performance

maximum of 120% (previously uncapped) of the target level and to reduce the financial

performance threshold from 95% to 90% of the target level to better reflect the practices

of our market comparator group, where financial performance below the threshold would

result in no bonus payout and financial performance at or above the maximum would

result in a capped bonus payout of 300% of an individual’s target payout percentage; and

• the modification of the financial performance threshold and maximum levels for adjusted

EBITDA and ROIC underlying our performance share units to align with those of the

Teamshare bonus program as applicable (see ‘‘2014 Equity Awards’’ below for more detail).

2014 Say on Pay Vote. Once every three years, we provide the opportunity for our

shareholders to vote on a nonbinding basis with respect to our compensation program for named

executive officers, which is the time interval last approved by our shareholders on a nonbinding basis.

The advisory vote on our named executive officer compensation program was last held in 2014. Of the

total votes cast (excluding abstentions and broker non-votes), 96.0% were cast in support of the

program, which we view as overwhelmingly supportive of our compensation policies and decisions.

Accordingly, we do not believe the results required consideration of changes to our compensation

program. The next opportunity for our shareholders to vote to approve on a nonbinding basis the

compensation of our named executive officers will be at our 2017 annual meeting of shareholders.

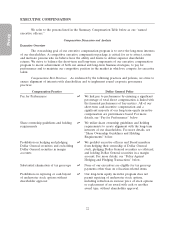

Executive Compensation Philosophy and Objectives

We strive to attract, retain and motivate persons with superior ability, to reward outstanding

performance, and to align the long-term interests of our named executive officers with those of our

shareholders. The material compensation principles applicable to the compensation of our named

executive officers are summarized below and discussed in more detail in ‘‘Elements of Named

Executive Officer Compensation’’:

• We generally target total compensation at a reasonable benchmarked median range of total

compensation of comparable positions within our market comparator group, but we make

adjustments based on circumstances, such as unique job descriptions and responsibilities as

well as our particular niche in the retail sector, that are not reflected in the market data.

For competitive or other reasons, our levels of total compensation or any component of

compensation may exceed or be below the median range of our market comparator group.

• We set base salaries to reflect the responsibilities, experience, performance and

contributions of the named executive officers and the salaries for comparable benchmarked

positions.

• We reward named executive officers who enhance our performance by linking cash and

equity incentives to the achievement of our financial goals.

• We promote share ownership to align the interests of our named executive officers with

those of our shareholders.

24