Dollar General 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

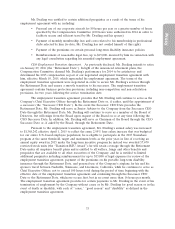

Mr. Dreiling’s outstanding equity awards will continue to vest, if at all, in accordance with the

terms of the applicable award agreements. The Transition RSU Award is a time-based award scheduled

to vest in full as of Mr. Dreiling’s voluntary termination of employment on or after the Retirement

Date, subject to accelerated vesting in the event of his termination of employment by the Company

without cause or by Mr. Dreiling for good reason or in the event of death or disability or a change in

control. Once vested, the Transition RSU Award is scheduled to be paid as to fifty percent of the

award on each of the first two anniversaries of the grant date, subject to accelerated payment in the

event of death or disability or a change in control prior to a payment date. Each of ‘‘cause,’’ ‘‘good

reason,’’ ‘‘disability’’ and ‘‘change in control’’ are as defined in the award agreement. The Transition

RSU Award will be payable in an equal number of shares of Company common stock, subject to

reduction, cancellation, forfeiture or recoupment, in whole or in part, upon various events specified in

the award agreement, including but not limited to the breach of the business protection provisions set

forth in the employment transition agreement.

Severance Arrangements

As noted above, we have an employment agreement with each of our named executive officers

and an employment transition agreement with Mr. Dreiling that, among other things, provides for such

executive’s rights upon a termination of employment. We believe that reasonable severance benefits are

appropriate to protect the named executive officer against circumstances over which he does not have

control and as consideration for the promises of non-disclosure, non-competition, non-solicitation and

non-interference that we require in our employment agreements. A change in control, by itself, does

not trigger any severance provision applicable to our named executive officers, except for the provisions

related to long-term equity incentives under our Amended and Restated 2007 Stock Incentive Plan.

Considerations Associated with Regulatory Requirements

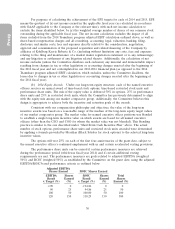

Section 162(m) generally disallows a tax deduction to any publicly held corporation for

individual compensation over $1 million paid in any taxable year to each of the persons who were, at

the end of the fiscal year, Dollar General’s CEO or one of the other named executive officers (other

than our CFO). Section 162(m) specifically exempts certain performance-based compensation from the

deduction limit.

If our Compensation Committee determines that our shareholders’ interests are best served by

the implementation of compensation policies that are affected by Section 162(m), our policies will not

restrict the Committee from exercising discretion to approve compensation packages even though that

flexibility may result in certain non-deductible compensation expenses.

We believe that our Amended and Restated 2007 Stock Incentive Plan currently satisfies the

requirements of Section 162(m), so that compensation expense realized in connection with stock

options and stock appreciation rights, if any, and in connection with performance-based restricted stock

and restricted stock unit awards, if any, can be deductible. However, restricted stock or restricted stock

units granted to executive officers that solely vest over time are not ‘‘performance-based compensation’’

under Section 162(m), so that compensation expense realized in connection with those time-vested

awards to executive officers covered by Section 162(m) will not be deductible by Dollar General.

In addition, any salary, signing bonuses or other annual compensation paid or imputed to the

executive officers covered by Section 162(m) that causes non-performance-based compensation to

exceed the $1 million limit will not be deductible by Dollar General. However, we believe that our

Amended and Restated Annual Incentive Plan currently satisfies the requirements of Section 162(m),

so that compensation expense realized in connection with short-term incentive payments under our

Teamshare program, if any, will be deductible.

The Committee administers our executive compensation program with the good faith intention

of complying with Section 409A of the Internal Revenue Code, which relates to the taxation of

nonqualified deferred compensation arrangements.

34