Dollar General 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

EXECUTIVE COMPENSATION

We refer to the persons listed in the Summary Compensation Table below as our ‘‘named

executive officers.’’

Compensation Discussion and Analysis

Executive Overview

The overarching goal of our executive compensation program is to serve the long-term interests

of our shareholders. A competitive executive compensation package is critical for us to attract, retain

and motivate persons who we believe have the ability and desire to deliver superior shareholder

returns. We strive to balance the short-term and long-term components of our executive compensation

program to incent achievement of both our annual and long-term business strategies, to pay for

performance and to maintain our competitive position in the market in which we compete for executive

talent.

Compensation Best Practices. As evidenced by the following practices and policies, we strive to

ensure alignment of interests with shareholders and to implement sound corporate governance

practices:

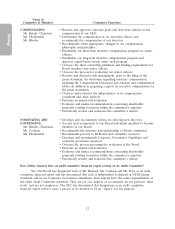

Compensation Practice Dollar General Policy

Pay for Performance ឡWe link pay to performance by ensuring a significant

percentage of total direct compensation is linked with

the financial performance of key metrics. All of our

short-term cash incentive compensation and a

significant majority of our long-term equity incentive

compensation are performance based. For more

details, see ‘‘Pay for Performance’’ below.

Share ownership guidelines and holding ឡWe utilize share ownership guidelines and holding

requirements requirements to create alignment with the long-term

interests of our shareholders. For more details, see

‘‘Share Ownership Guidelines and Holding

Requirements’’ below.

Prohibition on hedging and pledging ឡWe prohibit executive officers and Board members

Dollar General securities and on holding from hedging their ownership of Dollar General

Dollar General securities in margin stock, pledging Dollar General securities as collateral,

accounts and holding Dollar General securities in a margin

account. For more details, see ‘‘Policy Against

Hedging and Pledging Transactions’’ below.

Substantial elimination of tax gross-ups ឡNone of our executives are eligible for tax gross-up

payments other than on relocation-related items.

Prohibition on repricing or cash buyout ឡOur long-term equity incentive program does not

of underwater stock options without permit repricing of underwater stock options,

shareholder approval including reduction in exercise price of stock options

or replacement of an award with cash or another

award type, without shareholder approval.

22