Dollar General 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

labor dispute on the U.S. west coast all contributed to a decrease in our overall gross profit rate in

2014. We believe that both tobacco and perishables are significant drivers of customer traffic that

should lead to increases in average purchase amount. We expect the improvement in our net sales from

these initiatives will outweigh the corresponding reduction in our gross profit rate. In addition, we have

ongoing efforts to reduce product costs including shrink reduction, effective category management,

utilization of private brands, distribution and transportation efficiencies and additional improvements to

our pricing and markdown business model, among others, while remaining committed to our everyday

low price strategy. In our consumables category, we strive to offer the optimal balance of the most

popular nationally advertised brands and our own private brands, which generally have higher gross

profit rates than national brands. We believe that our core customer is continuing to seek out and

purchase goods at entry level price points and is doing so with greater frequency. To this end, we

increased our offering of $1 food items and the number of offerings from our Smart & Simple brand.

Commodities cost inflation was minimal in 2014 and, in some instances, we experienced a decrease in

such costs. Accordingly, overall price increases passed through to our customers were minimal. We have

seen positive results from our home and apparel segments, and remain committed to all of our

non-consumables categories, including seasonal. We expect the growth of consumables to continue to

outpace the non-consumables categories again in 2015, albeit to a lesser degree than in recent years,

due in part to the anticipated continued economic pressures discussed above.

Our third priority is leveraging process improvements and information technology to reduce costs.

We are committed as an organization to reduce costs, particularly selling, general and administrative

expenses (‘‘SG&A’’) that do not affect the customer experience. In 2014, our financial results reflect a

significant increase in incentive compensation expense, as the 2013 threshold financial performance

level required under our annual cash incentive compensation program was not met. Additionally, rent

and utilities costs contributed to the increase in SG&A. Conversely, we again successfully lowered our

store labor costs as a percentage of sales, in part, by simplifying various tasks performed in the stores.

Going forward, we will continue to simplify or eliminate unnecessary work and optimize labor in our

stores and elsewhere in the company. Additional items that were lower as a percentage of sales include

workers’ compensation and general liability expenses.

Our fourth priority is to strengthen and expand Dollar General’s culture of serving others. For

customers this means helping them ‘‘Save time. Save money. Every day!’’ by providing clean,

well-stocked stores with quality products at low prices. For employees, this means creating an

environment that attracts and retains key employees throughout the organization. For the public, this

means giving back to our store communities through our charitable and other efforts. For shareholders,

this means meeting their expectations of an efficiently and profitably run organization that operates

with compassion and integrity.

Our continued focus on these four priorities, coupled with strong cash flow management and share

repurchases, resulted in solid overall operating and financial performance in 2014 as compared to 2013

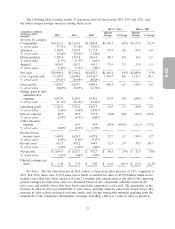

as follows. Basis points, as referred to below, are equal to 0.01 percent of total sales.

• Net sales in 2014 increased 8.0% over 2013. Sales in same-stores increased 2.8%, with increases

in both customer traffic and average transaction amount. Consumables represented 76% of sales

in 2014 and drove 82% of the total increase. Departments with the most significant increases

were tobacco, perishables and candy and snacks. Average sales per square foot in 2014 were

$223, up from $220 in 2013.

• Operating profit increased 1.9% to $1.77 billion, or 9.4% of sales, compared to $1.74 billion, or

9.9% of sales in 2013. The decrease in our operating profit rate was attributable to a 36 basis-

point decrease in our gross profit rate, coupled with a 19 basis-point increase in SG&A.

30