Dollar General 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

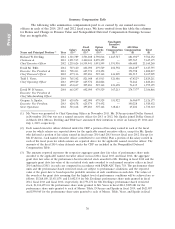

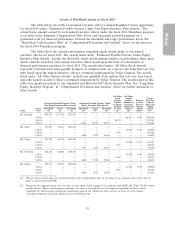

The bonus payable to each named executive officer upon satisfaction of the 2014 target

adjusted EBIT performance level is equal to the applicable target percentage, as set forth in the chart

below, of the applicable salary. For all named executive officers, such percentages are consistent with

those in effect at the end of the prior year and, except for Messrs. Dreiling and Vasos (for whom the

market value was not blended), such percentages reflect a blend of the approximate median of the

payout percentages for the market comparator group.

Name Target Payout Percentage

Mr. Dreiling 130%

Mr. Vasos 80%

Mr. Tehle 65%

Mr. D’Arezzo 65%

Mr. Sparks 65%

Performance between 90% (threshold) and 100% of the financial performance target, as well as

between 100% and 120% (maximum) of the financial performance target, is interpolated on a

straight-line basis on actual results for a bonus payout of between 50% (at threshold), 100% (at target)

and 300% (at maximum) of the individual’s target payout percentage.

(b) 2014 Teamshare Results. The Compensation Committee confirmed the adjusted EBIT

performance result at $1.795 billion (96.97% of target), which equates to a payout of 84.84% of

individual bonus targets under the 2014 Teamshare program. Accordingly, a 2014 Teamshare payout was

made to each named executive officer at the following percentages of base salary earned: Mr. Dreiling,

110.29%; Mr. Vasos, 67.87%; and each of Messrs. Tehle, D’Arezzo and Sparks, 55.14%. Such amounts

are reflected in the ‘‘Non-Equity Incentive Plan Compensation’’ column of the Summary Compensation

Table.

Long-Term Equity Incentive Program. Long-term equity incentives motivate named executive

officers to focus on long-term success for shareholders. These incentives help provide a balanced focus

on both short-term and long-term goals and are important to our compensation program’s recruiting

and retention objectives. Such incentives are designed to compensate named executive officers for a

long-term commitment to us, while motivating sustained increases in our financial performance and

shareholder value.

Equity awards are made under our shareholder-approved Amended and Restated 2007 Stock

Incentive Plan and options are granted with a per share exercise price equal to the fair market value of

one share of our common stock on the date of grant.

(a) 2012 Performance-Based Restricted Stock Award. In March 2012 the Compensation

Committee awarded Mr. Dreiling a grant of 326,037 performance-based restricted shares of our

common stock which could be earned upon the satisfaction of certain earnings per share (‘‘EPS’’)

performance targets for fiscal years 2014 and 2015. The EPS goals were established by the Committee

on the grant date based upon EPS forecasts contained in our long-term strategic plan. Half of the

performance-based restricted stock vested after the end of our 2014 fiscal year as a result of

achievement of the EPS goal of $3.61, and the other half is eligible to vest after the end of our 2015

fiscal year if the EPS goal for that year is achieved. The vesting of the 2015 tranche is subject to

continued employment with us through the date on which it is determined that the EPS goal has been

achieved and certain accelerated vesting provisions. In light of Mr. Dreiling’s announced retirement, we

do not currently anticipate that Mr. Dreiling will remain employed with us through the date necessary

for vesting of the 2015 tranche.

29