Dollar General 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

Accounting standards

In July 2013, the Financial Accounting Standards Board issued an accounting standards update

which relates to the presentation of an unrecognized tax benefit when a net operating loss

carryforward, a similar tax loss, or a tax credit carryforward exists. The Company’s adoption of this

guidance in the first quarter of 2014 did not have a material effect on the Company’s condensed

consolidated financial statements.

In May 2014, the Financial Accounting Standards Board issued comprehensive new accounting

standards related to the recognition of revenue. This guidance is effective for annual reporting periods

beginning after December 15, 2016, and early adoption is not permitted. The new guidance allows for

companies to use either a full retrospective or a modified retrospective approach in the adoption of

this guidance, and the Company is evaluating these transition approaches. The Company will adopt this

guidance in the first quarter of fiscal year 2017 and is currently in the process of evaluating the effect

of adoption on its consolidated financial statements.

Reclassifications

Certain financial disclosures relating to prior periods may have been reclassified to conform to the

current year presentation.

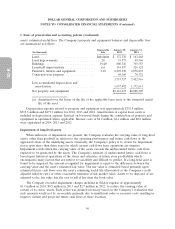

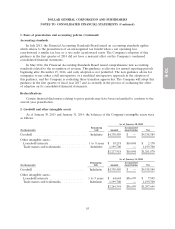

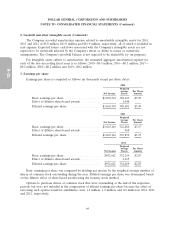

2. Goodwill and other intangible assets

As of January 30, 2015 and January 31, 2014, the balances of the Company’s intangible assets were

as follows:

As of January 30, 2015

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill .............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests ..................... 1 to 8 years $ 18,218 $16,048 $ 2,170

Trade names and trademarks .............. Indefinite 1,199,700 — 1,199,700

$1,217,918 $16,048 $1,201,870

As of January 31, 2014

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill ............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests .................... 1 to 9 years $ 64,644 $56,699 $ 7,945

Trade names and trademarks ............. Indefinite 1,199,700 — 1,199,700

$1,264,344 $56,699 $1,207,645

63