Dollar General 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

shopping centers. Most of our customers live within three to five miles, or a 10 minute drive, of our

stores.

Our typical store features a low cost, no frills building with limited maintenance capital, low

operating costs, and a focused merchandise offering within a broad range of categories, allowing us to

deliver low retail prices while generating strong cash flows and investment returns. Our initial capital

investment in new stores and relocations varies depending on the lease structure or ownership as well

as the size and location of the store and the number of coolers appropriate for the location.

We generally have had good success in locating suitable store sites in the past, and we believe that

there is ample opportunity for new store growth in existing and new markets. In addition, we believe

we have significant opportunities available for our relocation and remodel programs.

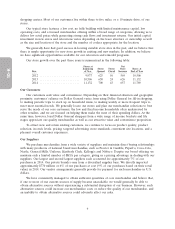

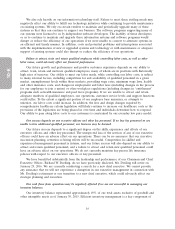

Our store growth over the past three years is summarized in the following table:

Stores at Net

Beginning Stores Stores Store Stores at

Year of Year Opened Closed Increase End of Year

2012 ....................... 9,937 625 56 569 10,506

2013 ....................... 10,506 650 24 626 11,132

2014 ....................... 11,132 700 43 657 11,789

Our Customers

Our customers seek value and convenience. Depending on their financial situation and geographic

proximity, customers’ reliance on Dollar General varies from using Dollar General for fill-in shopping,

to making periodic trips to stock up on household items, to making weekly or more frequent trips to

meet most essential needs. We generally locate our stores and plan our merchandise selections to best

serve the needs of our core customers, the low and fixed income households often underserved by

other retailers, and we are focused on helping them make the most of their spending dollars. At the

same time, however, loyal Dollar General shoppers from a wide range of income brackets and life

stages appreciate our quality merchandise as well as our attractive value and convenience proposition.

To attract new and retain existing customers, we continue to focus on product quality, product

selection, in-stock levels, pricing, targeted advertising, store standards, convenient site locations, and a

pleasant overall customer experience.

Our Suppliers

We purchase merchandise from a wide variety of suppliers and maintain direct buying relationships

with many producers of national brand merchandise, such as Procter & Gamble, PepsiCo, Coca-Cola,

Nestle, General Mills, Unilever, Kimberly Clark, Kellogg’s and Nabisco. Despite our broad offering, we

maintain only a limited number of SKUs per category, giving us a pricing advantage in dealing with our

suppliers. Our largest and second largest suppliers each accounted for approximately 7% of our

purchases in 2014. Our private brands come from a diversified supplier base. We directly imported

approximately $770 million or 6% of our purchases at cost (9% of our purchases based on their retail

value) in 2014. Our vendor arrangements generally provide for payment for such merchandise in U.S.

dollars.

We have consistently managed to obtain sufficient quantities of core merchandise and believe that,

if one or more of our current sources of supply became unavailable, we would generally be able to

obtain alternative sources without experiencing a substantial disruption of our business. However, such

alternative sources could increase our merchandise costs or reduce the quality of our merchandise, and

an inability to obtain alternative sources could adversely affect our sales.

6