Dollar General 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

For purposes of calculating the achievement of the EPS targets for each of 2014 and 2015, EPS

means the quotient of (x) net income earned in the applicable fiscal year (as calculated in accordance

with GAAP applicable to the Company at the relevant time), with such net income calculation to

exclude the items identified below, by (y) the weighted average number of shares of our common stock

outstanding during the applicable fiscal year. The net income calculation excludes the impact of all

items excluded from the 2014 Teamshare program adjusted EBIT calculation outlined above, as well as

share-based compensation charges and all consulting, accounting, legal, valuation, banking, filing,

disclosure and similar costs, fees and expenses directly related to the consideration, negotiation,

approval and consummation of the proposed acquisition and related financing of the Company by

affiliates of Kohlberg Kravis Roberts & Co. (including without limitation any costs, fees and expenses

relating to the filing and maintenance of a market maker registration statement or to any refinancings)

and any litigation or settlement of any litigation related thereto. Additionally, the calculation of net

income excludes (unless the Committee disallows such exclusion) any material and demonstrable impact

resulting from changes in tax or other legislation or accounting changes enacted after the beginning of

the 2012 fiscal year and not contemplated in our 2012-2016 financial plan (as opposed to the 2014

Teamshare program adjusted EBIT calculation, which excludes, unless the Committee disallows, the

losses due to changes in tax or other legislation or accounting changes enacted after the beginning of

the 2014 fiscal year).

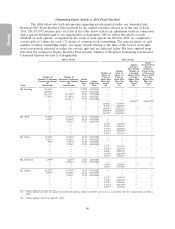

(b) 2014 Equity Awards. Under our long-term equity structure, each of the named executive

officers receives an annual award of time-based stock options, time-based restricted stock units and

performance share units. The mix of the equity value is delivered 50% in options, 25% in performance

share units and 25% in restricted stock units, which the Committee has previously determined to align

with the equity mix among our market comparator group. Additionally, the Committee believes this

design is appropriate to achieve both the incentive and retention goals of the awards.

Consistent with our compensation philosophy and objectives, the value of the long-term

incentive awards was based on a reasonable range of the median of the long-term equity target values

of our market comparator group. The market value for named executive officer positions was blended

to establish a single long-term incentive value on which awards are based for all named executive

officers (other than the CEO and COO for whom the market value was not blended). This blending

practice is similar to the one described under ‘‘Short-Term Cash Incentive Plan’’ above. The actual

number of stock options, performance share units and restricted stock units awarded were determined

by applying a formula provided by Meridian (Black Scholes for stock options) to the selected long-term

incentive values.

The options will vest 25% on each of the first four anniversaries of the grant date, subject to

the named executive officer’s continued employment with us and certain accelerated vesting provisions.

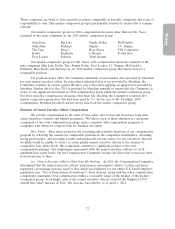

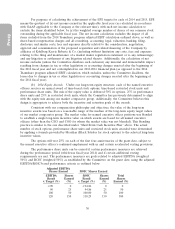

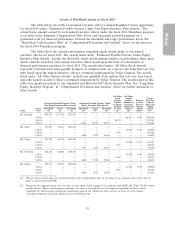

The performance share units can be earned if certain performance measures are achieved

during the performance period (which was fiscal year 2014) and if certain additional vesting

requirements are met. The performance measures are goals related to adjusted EBITDA (weighted

50%) and ROIC (weighted 50%) as established by the Committee on the grant date, using the adjusted

EBITDA/ROIC-based performance criteria as outlined below:

Adjusted EBITDA

Shares Earned ROIC Shares Earned

EBITDA Shares ROIC Shares Total

Result Earned Result Earned Shares

v. Target (%) (%) v. Target (%) (%) Earned (%)

<90 0 <94.86 0 0

90 25 94.86 25 50

100 50 100.00 50 100

120 150 110.29 150 300

30