Dollar General 2014 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

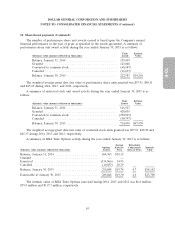

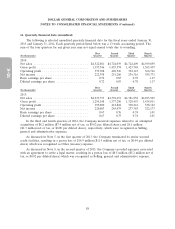

10. Share-based payments (Continued)

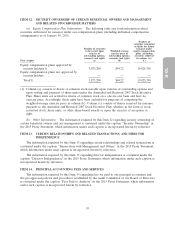

A summary of MSA Performance Options activity during the year ended January 30, 2015 is as

follows:

Average Remaining

Options Exercise Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Price Term in Years Value

Balance, January 31, 2014 ........................ 376,309 $19.68

Granted ..................................... — —

Exercised .................................... (118,287) 17.18

Canceled ..................................... (10,151) 21.47

Balance, January 30, 2015 ........................ 247,871 $20.79 4.9 $11,468

Exercisable at January 30, 2015 .................... 246,251 $20.73 4.9 $11,409

The intrinsic value of MSA Performance Options exercised during 2014, 2013 and 2012 was

$4.9 million, $39.1 million and $106.4 million, respectively.

In March 2012, the Company issued a performance-based award of 326,037 shares of restricted

stock to its Chairman and Chief Executive Officer. This restricted stock award had a fair value on the

grant date of $45.25 per share, with one-half of the award scheduled to vest in 2014 and the remainder

in 2015, contingent upon, among other things, meeting certain specified earnings per share targets in

those years. The target for 2014 was met and the applicable shares vested.

At January 30, 2015, the total unrecognized compensation cost related to nonvested stock-based

awards was $55.2 million with an expected weighted average expense recognition period of 1.4 years.

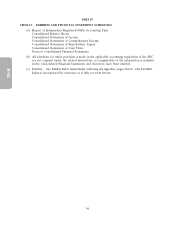

The fair value method of accounting for share-based awards resulted in share-based compensation

expense (a component of SG&A expenses) and a corresponding reduction in net income before income

taxes as follows:

Stock Performance Restricted Restricted

(In thousands) Options Share Units Stock Units Stock Total

Year ended January 30, 2015

Pre-tax ............................ $ 8,533 $5,461 $15,968 $7,376 $37,338

Net of tax .......................... $ 5,206 $3,332 $ 9,742 $4,500 $22,780

Year ended January 31, 2014

Pre-tax ............................ $ 7,634 $3,448 $ 9,879 $ — $20,961

Net of tax .......................... $ 4,649 $2,100 $ 6,016 $ — $12,765

Year ended February 1, 2013

Pre-tax ............................ $14,078 $4,082 $ 3,504 $ — $21,664

Net of tax .......................... $ 8,578 $2,487 $ 2,135 $ — $13,200

86