Dollar General 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

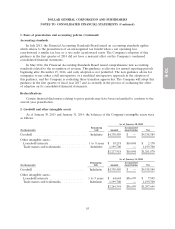

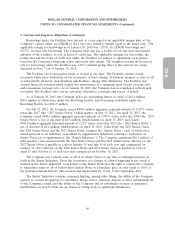

4. Income taxes

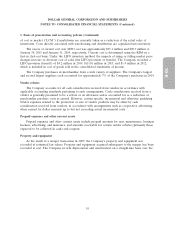

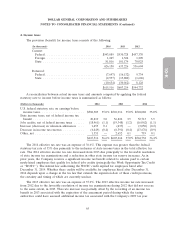

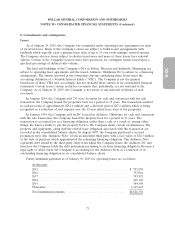

The provision (benefit) for income taxes consists of the following:

(In thousands) 2014 2013 2012

Current:

Federal ............................... $543,089 $530,728 $457,370

Foreign ............................... 1,245 1,324 1,209

State ................................ 81,816 101,174 78,025

626,150 633,226 536,604

Deferred:

Federal ............................... (7,697) (16,132) 9,734

State ................................ (2,937) (13,880) (1,606)

(10,634) (30,012) 8,128

$615,516 $603,214 $544,732

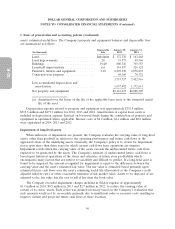

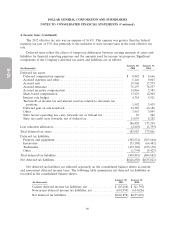

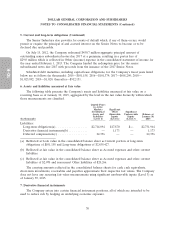

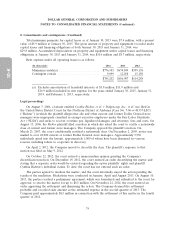

A reconciliation between actual income taxes and amounts computed by applying the federal

statutory rate to income before income taxes is summarized as follows:

(Dollars in thousands) 2014 2013 2012

U.S. federal statutory rate on earnings before

income taxes ......................... $588,303 35.0% $569,916 35.0% $524,088 35.0%

State income taxes, net of federal income tax

benefit ............................. 49,819 3.0 56,822 3.5 52,713 3.5

Jobs credits, net of federal income taxes ...... (18,961) (1.1) (19,348) (1.2) (16,062) (1.1)

Increase (decrease) in valuation allowances .... 1,453 0.1 (437) — (3,050) (0.2)

Decrease in income tax reserves ............ (6,449) (0.4) (6,391) (0.4) (13,676) (0.9)

Other, net ............................ 1,351 — 2,652 0.1 719 0.1

$615,516 36.6% $603,214 37.0% $544,732 36.4%

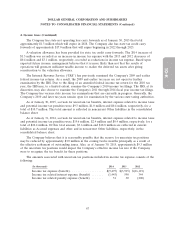

The 2014 effective tax rate was an expense of 36.6%. This expense was greater than the federal

statutory tax rate of 35% due primarily to the inclusion of state income taxes in the total effective tax

rate. The 2014 effective income tax rate decreased from 2013 due principally to the favorable resolution

of state income tax examinations and a reduction in other state income tax reserve increases. As in

prior years, the Company receives a significant income tax benefit related to salaries paid to certain

newly hired employees that qualify for federal jobs credits (principally the Work Opportunity Tax Credit

or ‘‘WOTC’’). The federal law authorizing the WOTC credit expired for employees hired after

December 31, 2014. Whether these credits will be available for employees hired after December 31,

2014 depends upon a change in the tax law that extends the expiration date of these credit provisions,

the certainty and timing of which are currently unclear.

The 2013 effective tax rate was an expense of 37.0%. The 2013 effective income tax rate increased

from 2012 due to the favorable resolution of income tax examinations during 2012 that did not reoccur,

to the same extent, in 2013. This rate increase was partially offset by the recording of an income tax

benefit in 2013 associated with the expiration of the assessment period during which the taxing

authorities could have assessed additional income tax associated with the Company’s 2009 tax year.

65