Dollar General 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

Share Repurchase Program

On March 10, 2015, the Company’s Board of Directors authorized a $1.0 billion increase to our

existing common stock repurchase program. The total remaining authorization is approximately

$1.2 billion at March 12, 2015. Under the authorization, purchases may be made in the open market or

in privately negotiated transactions from time to time subject to market and other conditions, and the

authorization has no expiration date. For more detail about our share repurchase program, see Note 12

to the consolidated financial statements.

Other Considerations

On March 10, 2015, the Board of Directors approved a quarterly cash dividend to shareholders of

$0.22 per share which will be paid on April 22, 2015 to shareholders of record on April 8, 2015.

Although the Board currently intends to continue regular quarterly cash dividends, the payment of

future cash dividends are subject to the Board’s discretion and will depend upon, among other things,

our results of operations, cash requirements, financial condition, contractual restrictions and other

factors that our Board may deem relevant.

Our inventory balance represented approximately 49% of our total assets exclusive of goodwill and

other intangible assets as of January 30, 2015. Our ability to effectively manage our inventory balances

can have a significant impact on our cash flows from operations during a given fiscal year. Inventory

purchases are often somewhat seasonal in nature, such as the purchase of warm-weather or Christmas-

related merchandise. Efficient management of our inventory has been and continues to be an area of

focus for us.

As described in Note 8 to the consolidated financial statements, we are involved in a number of

legal actions and claims, some of which could potentially result in material cash payments. Adverse

developments in those actions could materially and adversely affect our liquidity. We also have certain

income tax-related contingencies as disclosed in Note 4 to the consolidated financial statements. Future

negative developments could have a material adverse effect on our liquidity.

Cash Flows

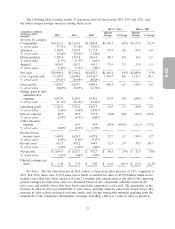

Cash flows from operating activities. Cash flows from operating activities were $1.31 billion in

2014, an increase of $101.7 million compared to 2013. Significant components of the increase in cash

flows from operating activities in 2014 compared to 2013 include increased net income due primarily to

increased sales and operating profit in 2014 as described in more detail above under ‘‘Results of

Operations.’’ Merchandise inventories increased by a greater amount in 2014 compared to 2013, which

was partially offset by accounts payable, which increased by $97.2 million in 2014 compared to a

$36.9 million increase in 2013. The increase in accounts payable during 2014 was due primarily to the

volume and timing of domestic merchandise receipts. On an ongoing basis, we closely monitor and

manage our inventory balances, and they may fluctuate from period to period based on new store

openings, the timing of purchases, and other factors. Merchandise inventories increased by 9% during

2014, compared to a 7% increase in 2013. Inventory levels in the consumables category increased by

$178.4 million, or 12%, in 2014 compared to an increase of $168.0 million, or 12%, in 2013. The

seasonal category increased by $13.8 million, or 3%, in 2014 compared to a decrease of $4.7 million, or

1%, in 2013. The home products category was essentially unchanged in 2014 compared to an increase

of $22.0 million, or 9%, in 2013. The apparel category increased by $37.1 million, or 13%, in 2014

compared to a decrease of $29.5 million, or 9%, in 2013.

Significant components of the increase in cash flows from operating activities in 2013 compared to

2012 include increased net income due primarily to increased sales and lower SG&A expenses, as a

percentage of sales, in 2013 as described in more detail above under ‘‘Results of Operations.’’

Significant components of the increase in cash flows from operating activities were related to changes

40