Dollar General 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

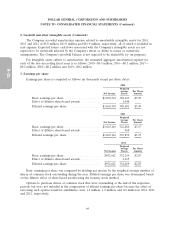

2. Goodwill and other intangible assets (Continued)

The Company recorded amortization expense related to amortizable intangible assets for 2014,

2013 and 2012 of $5.8 million, $11.9 million and $16.9 million, respectively, all of which is included in

rent expense. Expected future cash flows associated with the Company’s intangible assets are not

expected to be materially affected by the Company’s intent or ability to renew or extend the

arrangements. The Company’s goodwill balance is not expected to be deductible for tax purposes.

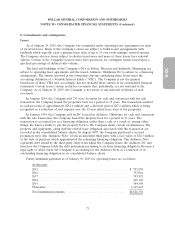

For intangible assets subject to amortization, the estimated aggregate amortization expense for

each of the five succeeding fiscal years is as follows: 2015—$0.9 million, 2016—$0.3 million, 2017—

$0.2 million, 2018—$0.2 million and 2019—$0.2 million.

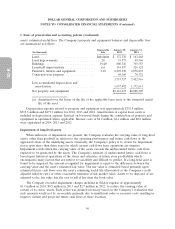

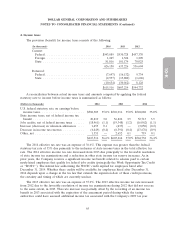

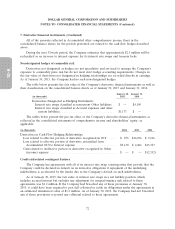

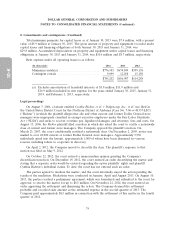

3. Earnings per share

Earnings per share is computed as follows (in thousands except per share data):

2014

Weighted

Average Per Share

Net Income Shares Amount

Basic earnings per share .................... $1,065,345 304,633 $3.50

Effect of dilutive share-based awards ........... 1,048

Diluted earnings per share .................. $1,065,345 305,681 $3.49

2013

Weighted

Average Per Share

Net Income Shares Amount

Basic earnings per share .................... $1,025,116 322,886 $3.17

Effect of dilutive share-based awards ........... 968

Diluted earnings per share .................. $1,025,116 323,854 $3.17

2012

Weighted

Average Per Share

Net Income Shares Amount

Basic earnings per share ..................... $952,662 332,254 $2.87

Effect of dilutive share-based awards ............ 2,215

Diluted earnings per share ................... $952,662 334,469 $2.85

Basic earnings per share was computed by dividing net income by the weighted average number of

shares of common stock outstanding during the year. Diluted earnings per share was determined based

on the dilutive effect of share-based awards using the treasury stock method.

Options to purchase shares of common stock that were outstanding at the end of the respective

periods, but were not included in the computation of diluted earnings per share because the effect of

exercising such options would be antidilutive, were 1.2 million, 1.2 million, and 0.8 million in 2014, 2013

and 2012, respectively.

64